A Quote by James Buchan

At the heart of banking is a suicidal strategy. Banks take money from the public or each other on call, skim it for their own reward and then lock the rest up in volatile, insecure and illiquid loans that at times they cannot redeem without public aid.

Related Quotes

We survived for hundreds of years under the old banking structure. You'd have clearing banks, then merchant banks doing the racy stuff, and then building societies where you'd join a waiting list for a mortgage. But then banks started buying stockbrokers, doing mortgages, and you ended up with these big banking groups doing everything.

Both in the US and throughout the world, there needs to be a growing presence of public development banks. These banks would make loans based on social welfare criteria - including advancing a full-employment, climate-stabilization agenda - as opposed to scouring the globe for the largest profit opportunities regardless of social costs.... Public development banks have always played a central role in supporting the successful economic development paths in the East Asian economies.

I basically see two reasons for a going public: Glencore gets access to more money. It is a way of funding your business and to finance growth. Plus: You have more liquid shares. It is easier to leave the company and redeem your shares. The 'going public' may also be an exit strategy for the top management.

I passionately disagreed with Treasury Secretary Hank Paulson's plan to bail out the banks by using a public fund called the Troubled Asset Relief Program (TARP) to help banks take toxic assets off their balance sheets. I argued that it would be much better to put the money where the hole was and replenish the equity of the banks themselves.

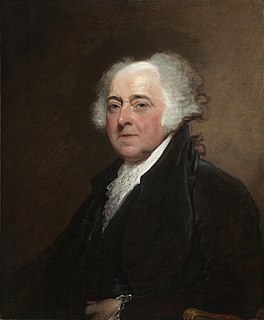

Public virtue cannot exist in a nation without private, and public virtue is the only foundation of republics. There must be a positive passion for the public good, the public interest, honour, power and glory, established in the minds of the people, or there can be no republican government, nor any real liberty: and this public passion must be superiour to all private passions.

Instead of abandoning competition and giving banks protected monopolies once again, the public would be better served by making it easier to close banks when they get into trouble. Instead of making banking boring, let us make it a normal industry, susceptible to destruction in the face of creativity.

Trying to avert foreclosures, once you can't just force the banks to do it as a condition of getting aid, means that you have to put some public money into it or you have to do other things that are politically unpopular. From the macroeconomic standpoint there is overwhelming need to help people reduce what they owe so that we don't get the foreclosures and we don't get people kicked out of their homes. On the other hand, there is great resistance politically to helping people, not all of whom would be worth recipients of the help.