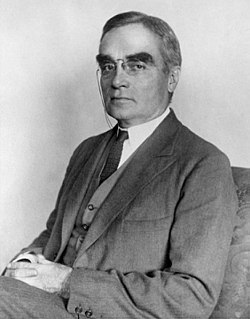

A Quote by James Buchan

Cause and effect, the riddle of all history, is a particular devil in financial history; and never more so than today, where entire classes of security are collapsing not on public exchanges and stock-tickers but because there are no markets to establish prices this side of nothing.

Related Quotes

There's no denying that a collapse in stock prices today would pose serious macroeconomic challenges for the United States. Consumer spending would slow, and the U.S. economy would become less of a magnet for foreign investors. Economic growth, which in any case has recently been at unsustainable levels, would decline somewhat. History proves, however, that a smart central bank can protect the economy and the financial sector from the nastier side effects of a stock market collapse.

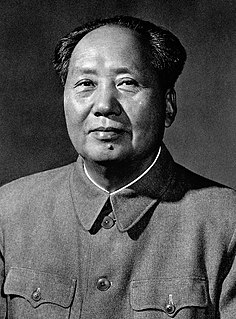

I don’t know much about history, and I wouldn’t give a nickel for all the history in the world. It means nothing to me. History is more or less bunk. It's tradition. We don't want tradition. We want to live in the present and the only history that is worth a tinker's damn is the history we make today.

Trading is a small part of the work of the stock exchanges. They are really to do with financial speculation, and they speculate on the value of the yen, the dollar, the pound, the franc, or the euro, at any given time. Billions are lost and billions are made by this speculation, and that's what the stock exchanges are about. They are for greedy minds.

I've always been interested in history, but they never taught Negro history in the public schools...I don't see how a history of the United States can be written honestly without including the Negro. I didn't [paint] just as a historical thing, but because I believe these things tie up with the Negro today. We don't have a physical slavery, but an economic slavery. If these people, who were so much worse off than the people today, could conquer their slavery, we can certainly do the same thing....I am not a politician. I'm an artist, just trying to do my part to bring this thing about.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

In the richest country in the history of the world, this Obama economy has crushed the middle class. Family income has fallen by $4,000, but health insurance premiums are higher, food prices are higher, utility bills are higher, and gasoline prices have doubled. Today more Americans wake up in poverty than ever before.

The most serious problems lie in the financial sphere, where the economy's debt overhead has grown more rapidly than the 'real' economy's ability to carry this debt. [...] The essence of the global financial bubble is that savings are diverted to inflate the stock market, bond market and real estate prices rather than to build new factories and employ more labor.