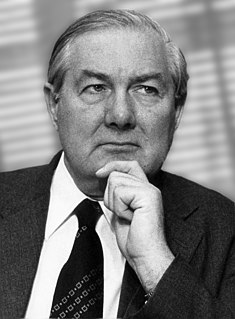

A Quote by James Callaghan

We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step.

Quote Topics

Bigger

Candour

Could

Cutting

Did

Dose

Each

Economy

Employment

Ever

Exist

Exists

Far

Followed

Government

Government Spending

Higher

Higher Level

Increase

Inflation

Level

Longer

Next

Next Step

Occasion

Only

Option

Out

Recession

Since

Spend

Spending

Step

Taxes

Tell

Think

Unemployment

Used

War

Way

Worked

Your

Related Quotes

Here's why I think the public service jobs are almost unavoidable: When we have downturns in the economy - and we will, for we haven't repealed the business cycle - unemployment will build, yet we no longer have any safety net. What are we going to do? Unless we decide to pull out all the stops and lower interest rates immediately and risk turning a recession into wild inflation, we're going to have to figure out some way of providing some more, not job security, but employment security.

People think of a business cycle, which is a boom followed by a recession and then automatic stabilizers revive the economy. But this time we can't revive. The reason is that every recovery since 1945 has begun with a higher, and higher level of debt. The debt is so high now, that since 2008 we've been in what I call, debt deflation.

With a congressional mandate to run the deficit up as high as need be, there is no reason to raise taxes now and risk aggravating the depression. Instead, Obama will follow the opposite of the Reagan strategy. Reagan cut taxes and increased the deficit so that liberals could not increase spending. Obama will raise spending and increase the deficit so that conservatives cannot cut taxes. And, when the economy is restored, he will raise taxes with impunity, since the only people who will have to pay them would be rich Republicans.

Because tax cuts create an incentive to increase output, employment, and production, they also help balance the budget by reducing means-tested government expenditures. A faster-growing economy means lower unemployment and higher incomes, resulting in reduced unemployment benefits and other social welfare programs.

I would cap the amount of federal government can spend at 20 percent of the economy. Bring it back to 20 percent or lower. And say, we are not going to spend above that level. Democrats, they want to raise your taxes and spend more and more and turn us into an economy which is no longer driven by the private sector.

No politician can praise unemployment or inflation, and there is no way of combining high employment with stable prices that does not involve some control of income and prices. Otherwise the struggle for more consumption and more income to sustain it-a struggle that modern corporations, modern unions and modern democracy all facilitate and encourage-will drive up prices. Only heavy unemployment will then temper this upward thrust. Not many wish to confront the truth that the modern economy gives a choice only between inflation, unemployment, or controls.

If I were a candidate for running, I'd say, "Look at what the economy has done." It's strong. We've created a lot of jobs. I'd be telling people that the Democrats will raise your taxes. I'd be reminding people that tax cuts have worked in terms of stimulating the economy. I'd be reminding people there's a philosophical difference between those who want to raise taxes and have the government spend the money, and those of us who say, "You get to spend the money the way you want to see fit. It's your money."

I argue that in the long run, the US would be on a far more financially secure footing if we recalibrate how we spend about two-to-three percent of the country's GNP, using state and federal taxes to create pools of money for spending on America's poor - which would, as numerous economists have argued in recent years, create virtuous spending circles, since those on lower incomes spend more of each extra dollar in their possession than do those on higher incomes.