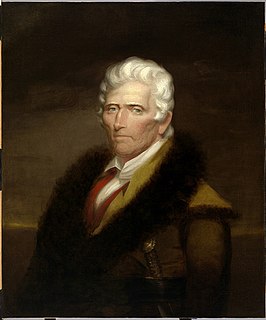

A Quote by James Cook

Liberals believe and inexhaustible fund exists that can be tapped endlessly to pay for government social programs. Tax the rich and give it to a long line of moochers, pork barrel hustlers and ne'er-do-wells. These funds would otherwise have been employed as additional capital indispensable to economic progress.

Related Quotes

Well, certainly the Democrats have been arguing to raise the capital gains tax on all Americans. Obama says he wants to do that. That would slow down economic growth. It's not necessarily helpful to the economy. Every time we've cut the capital gains tax, the economy has grown. Whenever we raise the capital gains tax, it's been damaged.

Unlike most government programs, Social Security and, in part, Medicare are funded by payroll taxes dedicated specifically to them. Some of the tax revenue pays for current benefits; anything that's left over goes into trust funds for the future. The programs were designed this way for political reasons.

I'll give you a simple formula for straightening out the problems of the United States. First, you tax the churches. You take the tax off of capital gains and the tax off of savings. You decriminalize all and tax them same way as you do alcohol. You decriminalize . You make gambling legal. That will put the budget back on the road to recovery, and you'll have plenty of tax revenue coming in for all of your social programs, and to run the army.

Conservatives in general, and even so called Tea Party conservatives, are not against transportation spending. Indeed, interstate commerce is one purpose of interstate highways and byways, and is one of the things the federal government is actually supposed to spend our tax dollars on. What conservatives are opposed to is needless and excessive spending, pork-barrel spending, deficit spending, spending to pick winners and losers among American individuals and corporations, and spending to promote the social and economic whims of the Washington few.

Conservatives and liberals are kindred spirits as far as government spending is concerned. First, let's make sure we understand what government spending is. Since government has no resources of its own, and since there's no Tooth Fairy handing Congress the funds for the programs it enacts, we are forced to recognize that government spending is no less than the confiscation of one person's property to give it to another to whom it does not belong - in effect, legalized theft.

Northleaf is delighted to have been chosen to manage the new fund. We look forward to implementing the fund's long-term strategy of constructing a portfolio of high-potential venture capital funds with the scale and resources to execute their plans, support successful high-growth companies and deliver world-class returns.

If you took every single penny that Warren Buffett has, it'd pay for 4-1/2 days of the US government. This tax-the-rich won't work. The problem here is the government is way bigger than even the capacity of the rich to sustain it. The Buffett Rule would raise $3.2 billion a year, and take 514 years just to pay off Obama's 2011 budget deficit.