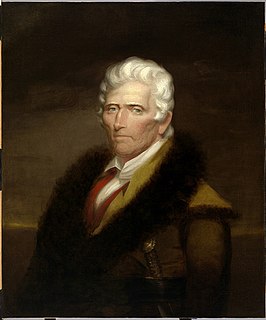

A Quote by James Cook

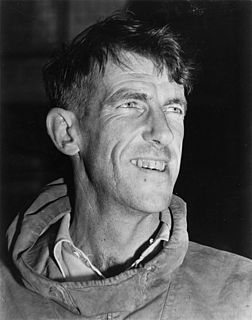

Why is it so hard to see that when America had high savings, low taxes and minimal government, the economy grew like a week, and today when we have just the opposite, the economy is shrinking.?

Related Quotes

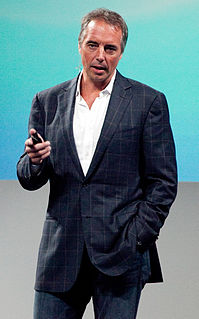

Today it's fashionable to talk about the New Economy, or the Information Economy, or the Knowledge Economy. But when I think about the imperatives of this market, I view today's economy as the Value Economy. Adding value has become more than just a sound business principle; it is both the common denominator and the competitive edge.

I think the reason that the Trump economic agenda is beneficial is, he is doing the right things. He wants to see growth, he wants to see to lower taxes, he wants to see this cash pile sitting outside the US return to the US. All of these things I think will be good for the US economy, and as I've said, if the US economy grows, the global economy benefits hugely.

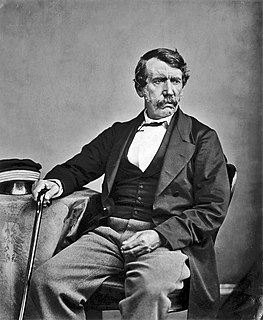

There's no easy way to say this, so I'??ll just say it: We're no longer No. 1. Today, we're No. 2. Yes, it's official. The Chinese economy just overtook the United States economy to become the largest in the world. For the first time since Ulysses S. Grant was president, America is not the leading economic power on the planet.

The tragedy of government welfare programs is not just wasted taxpayer money but wasted lives. The effects of welfare in encouraging the break-up of low-income families have been extensively documented. The primary way that those with low incomes can advance in the market economy is to get married, stay married, and work—but welfare programs have created incentives to do the opposite.