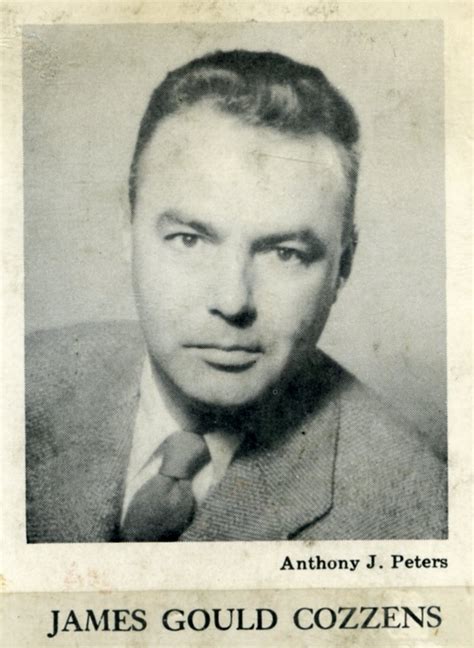

A Quote by James Gould Cozzens

The first test of ability and intelligence is to find a field of endeavor in which profits are large and risks small.

Related Quotes

In many ways, large profits are even more insidious than large losses in terms of emotional destabilization. I think it's important not to be emotionally attached to large profits. I've certainly made some of my worst trades after long periods of winning. When you're on a big winning streak, there's a temptation to think that you're doing something special, which will allow you to continue to propel yourself upward. You start to think that you can afford to make shoddy decisions. You can imagine what happens next. As a general rule, losses make you strong and profits make you weak.

...the test of a first-rate intelligence is the ability to hold two opposed ideas in the mind at the same time, and still retain the ability to function. One should, for example, be able to see that things are hopeless and yet be determined to make them otherwise. This philosophy fitted on to my early adult life, when I saw the improbable, the implausible, often the "impossible," come true.

The obstacles to peace are in the minds and hearts of men.

In the study of matter we can be honest, impartial, true. That is why we succeed in dealing with it. But about the things we care for — which are ourselves, our desires and lusts, our patriotisms and hates — we find a harder test of thinking straight and truly. Yet there is the greater need. Only by intellectual rectitude and in that field shall we be saved. There is no refuge but in truth, in human intelligence, in the unconquerable mind of man.

As a source of innovation, an engine of our economy, and a forum for our political discourse, the Internet can only work if it's a truly level playing field. Small businesses should have the same ability to reach customers as powerful corporations. A blogger should have the same ability to find an audience as a media conglomerate.

The trouble is that the risks that are being hedged very well by new financial securities are financial risks. And it appears to me that the real things you want to hedge are real risks, for example, risks in innovation. The fact is that you'd like companies to be able to take bigger chances. Presumably one obstacle to successful R&D, particularly when the costs are large, are the risks involved.