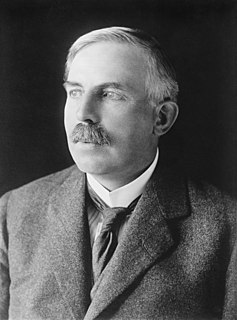

A Quote by James Grant

Debt is always repaid, either by the borrower or by the lender.

Related Quotes

Hudson Taylor and Charles Spurgeon believed that Romans prohibits debt altogether. However, if going into debt is always sin, it's difficult to understand why Scripture gives guidelines about lending and even encourages lending under certain circumstances. Proverbs says "the borrower is servant to the lender." It doesn't absolutely forbid debt, but it's certainly a strong warning.

Shipping first time code is like going into debt. A little debt speeds development so long as it is paid back promptly with a rewrite. The danger occurs when the debt is not repaid. Every minute spent on not-quite-right code counts as interest on that debt. Entire engineering organizations can be brought to a standstill under the debt load of an unconsolidated implementation, object-oriented or otherwise.