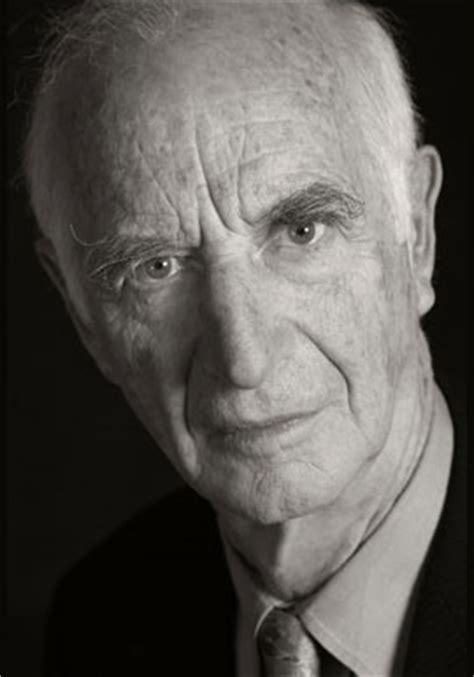

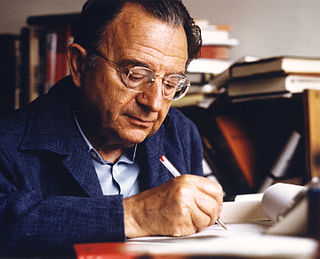

A Quote by James Hillman

Suppose that throughout your childhood you were good with numbers. Other kids used to copy your homework. You figured store discounts faster than your parents. People came to you for help with such things. So you took accounting and eventually became a tax auditor for the IRS. What an embarrassing job, right? You feel you should be writing poetry or doing aviation mechanics or whatever. But then you realize that tax collecting can be a calling too.

Quote Topics

Accounting

Aviation

Became

Calling

Came

Childhood

Collecting

Copy

Discounts

Doing

Embarrassing

Eventually

Faster

Feel

Figured

Good

Help

Homework

IRS

Job

Kids

Mechanics

Numbers

Other

Other Kids

Parents

People

Poetry

Realize

Right

Should

Store

Suppose

Tax

Than

Then

Things

Throughout

Too

Took

Used

Were

Whatever

Writing

Writing Poetry

Your

Your Child

Related Quotes

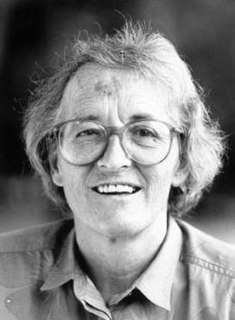

I remember when I was a kid, with the acting thing, I resented it because, you know, you don't want to do what your parents want you to do. You got your own things. And the whole idea of getting a job because of who your father is - that didn't feel right. But after a while I guess I figured I must be doing something right, because people wouldn't keep hiring me if I didn't have something to give.

Let's talk about how to fill out your 1984 tax return. Here's an often overlooked accounting technique that can save you thousands of dollars: For several days before you put it in the mail, carry your tax return around under your armpit. No IRS agent is going to want to spend hours poring over a sweat-stained document. So even if you owe money, you can put in for an enormous refund and the agent will probably give it to you, just to avoid an audit. What does he care? It's not his money.

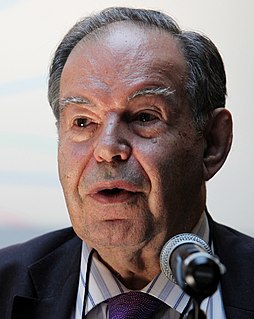

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.

When you say the tax system benefits the rich, there are a lot of people who respond, "That can't be true, look at the rate of tax. The people who are rich pay a higher rate than you or I." Well, yeah, but if you don't have to pay taxes on a lot of your income, then your real tax rate is a lot lower. And if you're allowed to pay your taxes thirty years from now instead of today then you're a lot better off. People need to have a sophisticated understanding of how the system works to appreciate that the posted tax rate really has very little to do with the taxes people pay.

The Value-Added Tax, a sales tax that applies at every level of business transactions, is an easy tax for governments to collect, and a hard tax to evade. So it makes the job of raising revenue easier. The revenues from the VAT can then be used to lower taxes on income and saving and investment. The Value-Added tax doesn't penalize work or saving; it's a tax on buying stuff.

The IRS spends God knows how much of your tax money on these toll-free information hot lines staffed by IRS employees, whose idea of a dynamite tax tip is that you should print neatly. If you ask them a real tax question, such as how you can cheat, they're useless. So, for guidance, you want to look to big business. Big business never pays a nickel in taxes, according to Ralph Nader, who represents a big consumer organization that never pays a nickel in taxes. . . .

If you're a full-time manager of your own property - and full-time, according to Congress, is 15 hours a week - you can take unlimited depreciation and use it to offset your income from other areas and pay little in tax. One of the biggest real estate tax lawyers in New York said to me, if you're a major real estate family and you're paying income taxes, you should sue your tax lawyer for malpractice.

I've come to realize that making it your life's work to be different than your parents is not only hard to do, it's a dumb idea. Not everything we found fault with was necessarily wrong; we were right, for example, to resent, as kids, being told when to go to bed. We'd be equally wrong, as parents, to let our kids stay up all night. To throw out all the tools of parenting just because our parents used them would be like making yourself speak English without using ten letters of the alphabet; it's hard to do.