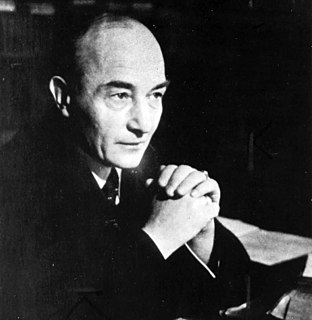

A Quote by James Hilton

Surely there comes a time when counting the cost and paying the price aren't things to think about any more. All that matters is value - the ultimate value of what one does.

Related Quotes

Nothing of value is free. Even the breath of life is purchased at birth only through gasping effort and pain... The best things in life are beyond money; their price is agony and sweat and devotion... and the price demanded for the most precious of all things in life is life itself--ultimate cost for perfect value

[W]e think the very term 'value investing' is redundant. What is 'investing' if it is not the act of seeking value at least sufficient to justify the amount paid? Consciously paying more for a stock than its calculated value -- in the hope that it can soon be sold for a still-higher price -- should be labeled speculation (which is neither illegal, immoral nor -- in our view -- financially fattening).

If in the human economy, a squash in the field is worth more than a bushel of soil, that does not mean that food is more valuable than soil; it means simply that we do not know how to value the soil. In its complexity and its potential longevity, the soil exceeds our comprehension; we do not know how to place a just market value on it, and we will never learn how. Its value is inestimable; we must value it, beyond whatever price we put on it, by respecting it.

Value in relation to price, not price alone, must determine your investment decisions. If you look to Mr Market as a creator of investment opportunities (where price departs from underlying value), you have the makings of a value investor. If you insist on looking to Mr Market for investment guidance however, you are probably best advised to hire someone else to manage your money.