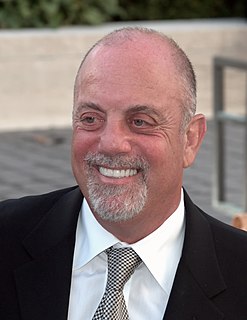

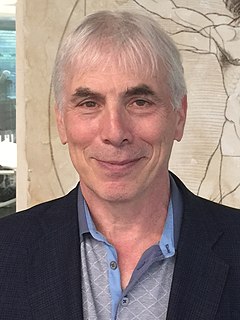

A Quote by James O'Shaughnessy

Fear, greed and hope have destroyed more portfolio value than any recession or depression we have ever been through.

Related Quotes

Fear! Fear again, for the first time since his 'teens. Fear, that he thought he would never know any more. Fear that no weapon, no jeopardy, no natural cataclysm, has ever been able to inspire until now. And now here it is running icily through him in the hot Chinese noon. Fear for the thing he loves, the only fear that can ever wholly cow the reckless and the brave.

Have you ever stopped to consider the power of words? Through mere words, wars have started and ended. Tender feelings have been hurt and soothed. Courage has been instilled and fear has been implanted. Lives have been destroyed and others changed for the better. Think back on your own life when words have hurt you deeply or have comforted and given you strength and hope to do better.

I think Welfare Reform did more harm than good, but one piece of good it did was it changed the attitudes of Americans. If we look at voter surveys even before the recession, the idea that people are poor because they're lazy was much stronger in the early '90s than it was even before the recession. Now with the recession, everybody knows somebody who is poor through no fault of their own. So voter attitudes are more favorable than they've been since the '60s.

But in the financial markets, without proper institutional rules, there's the law of the jungle - because there's greed! There's nothing wrong with greed, per se. It's not that people are more greedy now than they were 20 years ago. But greed has to be tempered, first, by fear of losses. So if you bail people out, there's less fear. And second, b prudential regulation and supervision to avoid certain excesses.

In the large sense the primary cause of the Great Depression was the war of 1914-1918. Without the war there would have been no depression of such dimensions. There might have been a normal cyclical recession; but, with the usual timing, even that readjustment probably would not have taken place at that particular period, nor would it have been a "Great Depression.

Hope drives us to invent new fixes for old messes, which in turn create ever more dangerous messes. Hope elects the politician with the biggest empty promise; and as any stockbroker or lottery seller knows, most of us will take a slim hope over prudent and predictable frugality. Hope, like greed, fuels the engine of capitalism.

That doctrine of peace at any price has done more mischief than any I can well recall that have been afloat in this country. It has occasioned more wars than any of the most ruthless conquerors. It has disturbed and nearly destroyed that political equilibrium so necessary to the liberties and the welfare of the world.