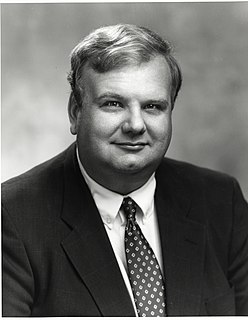

A Quote by James O'Shaughnessy

We believe that people moving their portfolios to an overweight in bonds will be disappointed over the long-term and will significantly underperform an asset allocation that over-weights equities.

Related Quotes

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

It's quite clear that stocks are cheaper than bonds. I can't imagine anybody having bonds in their portfolio when they can own equities, a diversified group of equities. But people do because they, the lack of confidence. But that's what makes for the attractive prices. If they had their confidence back, they wouldn't be selling at these prices. And believe me, it will come back over time.

We live in a very risky world and investors should not get "carried away" with excessive allocations to equities, or for that matter, real estate. As always asset allocation and low cost and broad diversification will be essential in earning one's fair share of whatever returns our financial markets are generous enough to bestow upon us.

The Bush Administration believes the Kyoto protocol could damage our collective prosperity, and in so doing, actually put our long-term environmental health at risk. Fundamentally, we believe that the protocol both will fail to significantly reduce the long-term risks posed by climate change and, in the short run, will seriously impede our ability to meet our energy needs and economic growth.

There is no doubt that the Fed's large-scale asset purchases have caused major increases in a number of asset prices in the economy. This is especially true of mortgage backed securities and corporate bonds, and quite possibly of equities as well. For those people and institutions holding those things, the run up in prices has been a wealth bonanza.

In the stock market (as in much of life), the beginning of wisdom is admitting your ignorance. One of the many things you cannot know about stocks is exactly when they will up or go down. Over the long term, stocks generally rise at a nice pace. History shows they double in value every seven years or so. But in the short term, stocks are just plain wild. Over periods of days, weeks and months, no one has any idea what they will do. Still, nearly all investors think they are smart enough to divine such short-term movements. This hubris frequently gets them into trouble.

I still believe that for good business analysts a concentrated portfolio is a good strategy combined with a long term horizon. Once again, the secret to success in following the formula strategy is patience, a quality in short supply for both professionals and individual investors alike. I think investors should have a large portion of their assets in equities over time.