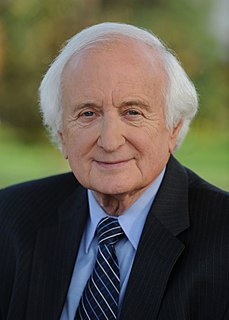

A Quote by James P. Gorman

Traditional consumer banking will come under extreme pressure as its central deposit-taking and lending functions are challenged by online savings vehicles, crowdfunding, and loan syndicating by such nontraditional competitors as insurance companies, pension and hedge funds.

Related Quotes

When I was 23, 24, I started covering hedge funds - a lot of this was luck - when no one else did. This was before hedge funds were the prettiest girl in school: this was pre-nose job and treadmill for hedge funds, when nobody talked to them - back then, it was just all about insurance companies and money managers.

Unemployment insurance, abolishing child labor, the 40-hour work week, collective bargaining, strong banking regulations, deposit insurance, and job programs that put millions of people to work were all described, in one way or another, as 'socialist.' Yet, these programs have become the fabric of our nation and the foundation of the middle class.