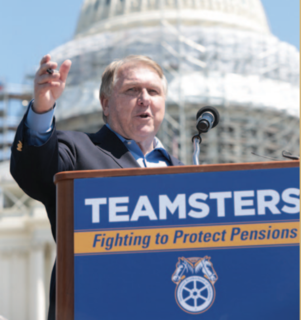

A Quote by James P. Hoffa

As president of the International Brotherhood of Teamsters, I have seen private equity firms plunder company after company, taking rich fees for themselves and cutting costs until there's nothing left to cut. Time and again I've seen their reckless behavior drive companies to declare bankruptcy.

Related Quotes

The biggest challenge is self-financing 100% of everything. Recording costs, studio time, engineer fees, travel costs are all a part of the creation process. Then after the creation, there are producer fees, mixing, mastering, photo shoots, artwork, packaging, artist feature fees, legal fees, clearances, and so on that must be covered before any music can officially be released to the public.

But, at the end of the day, we need to represent the taxpayers who have made enormous sacrifices. Many have lost their jobs. Many of them have seen their companies - they don't have a pension - they have seen their companies cut the match for their 401(k). They have seen their health care benefits be shredded.

One of the biggest reasons for higher medical costs is that somebody else is paying those costs, whether an insurance company or the government. What is the politicians' answer? To have more costs paid by insurance companies and the government. ... [H]aving someone else pay for medical care virtually guarantees that a lot more of it will be used. Nothing would lower costs more than having each patient pay those costs. And nothing is less likely to happen.

Some years ago one oil company bought a fertilizer company, and every other major oil company practically ran out and bought a fertilizer company. And there was no more damned reason for all these oil companies to buy fertilizer companies, but they didn't know exactly what to do, and if Exxon was doing it, it was good enough for Mobil and vice versa.