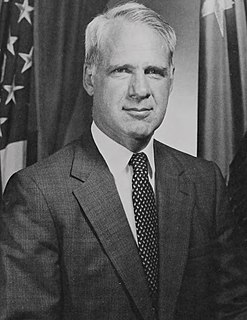

A Quote by James R. Schlesinger

Oil production should peak out around the world in the early 1990s...That means in five years' time we may have chewed up most of the possibility of further expansion of oil production.

Related Quotes

Saudi Arabian oil production is at or very near its peak sustainable volume (if it did not, in fact peak almost 25 years ago), and is likely to go into decline in the very foreseeable future. There is only a small probability that Saudi Arabia will ever deliver the quantities of petroleum that are assigned to it in all the major forecasts of world oil production and consumption.

There's a huge misconception that it's all about the oil, and the truth is there's actually not much oil left in Abyei. The misperception arose because when the peace agreement was signed in 2005, Abyei accounted for a quarter of Sudan's oil production. Since then, the Permanent Court of Arbitration in The Hague defined major oil fields to lie outside Abyei. They're in the north now, not even up for grabs, and they account for one percent of the oil in Sudan. The idea that it's "oil-rich Abyei" is out of date.

Bitumen is junk energy. A joule, or unit of energy, invested in extracting and processing bitumen returns only four to six joules in the form of crude oil. In contrast, conventional oil production in North America returns about 15 joules. Because almost all of the input energy in tar sands production comes from fossil fuels, the process generates significantly more carbon dioxide than conventional oil production.

Speculation in oil stock companies was another great evil ... From the first, oil men had to contend with wild fluctuations in the price of oil. ... Such fluctuations were the natural element of the speculator, and he came early, buying in quantities and holding in storage tanks for higher prices. If enough oil was held, or if the production fell off, up went the price, only to be knocked down by the throwing of great quantities of stocks on the market.

Even if we were to sign peace today, the economic conditions in our country would not improve automatically because it will take some time to reach the level of oil production before the war and the oil prices are likely to remain low for some time as the supply of oil in the world is high and demand is low.

We're supposed to believe that oil had nothing to do with it, that if Iraq were exporting pickles or jelly and the center of world oil production were in the South Pacific that the United States would've liberated them anyway. It has nothing to do with the oil, what a crass idea. Anyone with their head screwed on knows that that can't be true.

I do not remember when I said this [oil production would collapse ], maybe in the heat of the moment, but I do not think I even said it, but I may just not remember it. I was saying that at a certain level of oil prices new deposits will not be explored. That is what is actually happening. However, surprisingly, our oil and gas workers [mainly oilmen] continue to invest.

Oil now, as a result of the Saudi production, is priced so low that there are not going to be new fracking investments made. A lot of companies that have gone into fracking are heavily debt-leveraged, and are beginning to default on their loans. The next wave of defaults that banks are talking about is probably going to be in the fracking industry. When the costs of production are so much more than they can end up getting for the oil, they just stop producing and stop paying their loans.