A Quote by James Surowiecki

What corporations fear is the phenomenon now known, rather inelegantly, as 'commoditization.' What the term means is simply the conversion of the market for a given product into a commodity market, which is characterized by declining prices and profit margins, increasing competition, and lowered barriers to entry.

Related Quotes

Traditional sales and marketing involves increasing market shares, which means selling as much of your product as you can to as many customers as possible. One-to-one marketing involves driving for a share of customer, which means ensuring that each individual customer who buys your product buys more product, buys only your brand, and is happy using your product instead of another to solve his problem. The true, current value of any one customer is a function of the customer's future purchases, across all the product lines, brands, and services offered by you.

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.

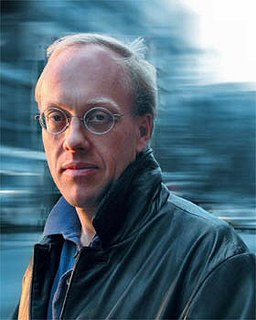

The corporations that profit from permanent war need us to be afraid. Fear stops us from objecting to government spending on a bloated military. Fear means we will not ask unpleasant questions of those in power. Fear permits the government to operate in secret. Fear means we are willing to give up our rights and liberties for promises of security. The imposition of fear ensures that the corporations that wrecked the country cannot be challenged. Fear keeps us penned in like livestock.