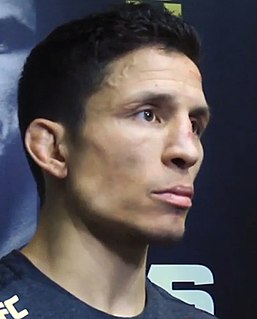

A Quote by James Williams

I think prices have been moving more on speculation than reality. But this is a market that has been driven by fear for two or three years.

Related Quotes

High prices can be the result of speculation, and maybe plunging prices can be attributed to the end of speculation, but low prices over time aren't caused by speculation. That's oversupply, mainly by Saudi Arabia flooding the market with low-priced oil to discourage rival oil producers, whether it's Russian oil or American fracking.

Technological advances have always been driven more by a mind-set of 'I can' than 'I should' Technologists love to cram maximum functionality into their products. That's 'I can' thinking, which is driven by peer competition and market forces But this approach ignores the far more important question of how the consumer will actually use the device focus on what we should be doing, not just what we can.

From the dawn of exact knowledge to the present day, observation, experiment, and speculation have gone hand in hand; and, whenever science has halted or strayed from the right path, it has been, either because its votaries have been content with mere unverified or unverifiable speculation (and this is the commonest case, because observation and experiment are hard work, while speculation is amusing); or it has been, because the accumulation of details of observation has for a time excluded speculation.

We're hopeful it won't climb much more than that (10 percent). The reality is we're all looking at the price per gallon of gasoline and heating oil, and even cord wood, and we're seeing prices that are volatile and I don't think anybody can accurately predict what we'll be paying for these commodities in two weeks, let alone two months.