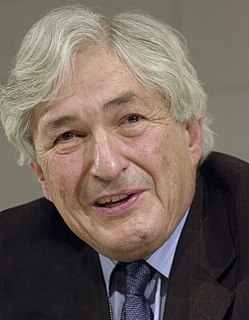

A Quote by James Wolfensohn

It's probably conventional wisdom now that you bring openness of markets only after the market has developed to a certain level.

Related Quotes

On the one hand, you have markets such as Singapore and Thailand, with an extremely strong inbound booker market and a well-developed tourism industry. You also have markets that are just opening up to tourists, like Myanmar, that have massive growth potential and then markets that are extremely fragmented within themselves such as Indonesia.

The hardest thing over the years has been having the courage to go against the dominant wisdom of the time to have a view that is at variance with the present consensus and bet that view. The hard part is that the investor must measure himself not by his own perceptions of his performance, but by the objective measure of the market. The market has its own reality. In an immediate emotional sense the market is always right so if you take a variant point of view you will always be bombarded for some time by conventional wisdom as expressed by the market.

I’ve never agreed with the conventional wisdom that ‘actors are great liars.’ If more people understood the acting process, the goals of good actors, the conventional wisdom would be ‘actors are terrible liars,’ because only bad actors lie on the job. The good ones hate fakery and avoid manufactured emotion at all costs. Any script is enough of a lie anyway. (What experience does any actor have with flying a spacecraft? Killing someone?) What’s called for, what actors are hired for, is to bring reality to the arbitrary.

There is a bit of a problem with the match between derivative securities markets and the primary markets. We have long ago instituted principles, essentially high margin requirements, to prevent certain instabilities in the stock market, and I think they're basically correct. The trouble is that there's a linkage, let's say, between something like the stock market and the index futures markets, and the fact that the margin requirements are very different, for example, played some role in the October '87 crash.

Markets are interested in profits and profits only; service, quality, and general affluence are different functions altogether. The universal, democratic prosperity that Americans now look back to with such nostalgia was achieved only by a colossal reigning in of markets, by the gargantuan effort of mass, popular organizations like labor unions and of the people themselves, working through a series of democratically elected governments not daunted by the myths of the market.

Like its agriculture, Africa's markets are highly under-capitalized and inefficient. We know from our work around the continent that transaction costs of reaching the market, and the risks of transacting in rural, agriculture markets, are extremely high. In fact, only one third of agricultural output produced in Africa even reaches the market.