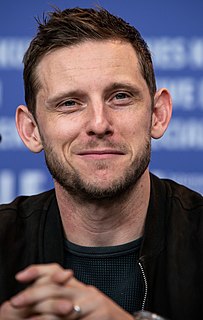

A Quote by Jamie Bell

Your credit card, your inbox, your Hotmail.com are not particularly secure. We are being watched; it's just a part of life.

Related Quotes

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

If you do not have at least an eight-month emergency fund, and you think there's a probability you could loose your job - and it's not just losing your job; you could be in a car accident, get sick - continue to pay the minimum on your credit card every month. Everything beyond that needs to go to establish an emergency fund. And if you have an emergency fund saved, then fund your retirement account before paying down credit card debt.

No one anticipates divorce when they're exchanging vows, and it can be devastating emotionally and financially. To ease the financial side of the blow, you need to maintain your financial identity in your relationship. That means having your own credit history - you need your own credit card - and your own savings and retirement accounts.

When it comes to building your business and developing a powerful network, you'll want to develop a reputation as someone who highlights others. Not only does this give credit where credit is due, it also communicates that you're secure with your success and have the ability to promote others in your industry.

Credit card companies are jacking up interest rates, lowering credit limits, and closing accounts - and people who have made timely payments are not exempt. So even if you pay off your balance - and that's tough when interest rates are insanely high - there's a good chance your credit limit will be slashed, and that will hurt your FICO score.