A Quote by Jamie Dimon

You've seen certain credit type products that are going to be in nonbanks, like sophisticated CLO [collateralized loan obligation] tranches and stuff where the capital charge is so high that a bank simply will not own it. Someone will buy it, hedge it, trade it. But it won't typically be a bank.

Related Quotes

I want to work in a bank, definitely. Hopefully, my acting career will go well. But if it doesn't, I go to a bank. If it does, then even at the age of 40, I will still go to a bank, but I have to work in a bank, because I'm really fond of taxation and accounts and investments and all of that. So I will do it. At some point, I will, yes.

My guess is the big Chinese banks will be in 100?countries by then. They will have very sophisticated operations, and they may very well have bought banks around the world in countries that allow it. I mean, I don't think the American government would allow them to buy JPMorgan. But they will be able to buy a sizable big bank in the U.S. at some point. Whether they do or not, or if it's allowed or not, I don't know.

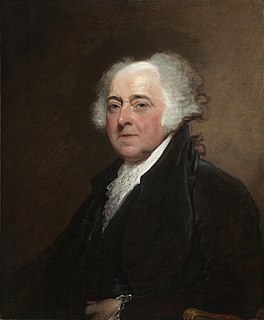

Our whole system of banks is a violation of every honest principle of banks. There is no honest bank but a bank of deposit. A bank that issues paper at interest is a pickpocket or a robber. But the delusion will have its course. ... An aristocracy is growing out of them that will be as fatal as the feudal barons if unchecked in time.

Beliefs constitute the basic stratum, that which lies deepest, in the architecture of our life. By them we live, and by the same token we rarely think of them.... One may symbolize the individual life as a bank of issue. The bank lives on the credit of a gold reserve which is rarely seen, which lies at the bottom of metal coffers hidden in the vaults of the building. The most elementary caution will suggest that from time to time the effective condition of these guaranties--of these credences, one might say, that are the basis of credit--be passed in review.

The federal [bank deposit] insurance scheme has worked up to now simply and solely because there have been very few bank failures. The next time we have a pestilence of them it will come to grief quickly enough, and if the good banks escape ruin with the bad ones it will be only because the taxpayer foots the bill.