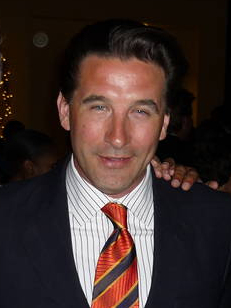

A Quote by Jamie Dimon

The real story in housing will be a recovery in the economy that will drive a recovery in housing, When people are working, when there are more jobs, more households forming and people go back to buying cars, they're going to want their apartments and homes. And that's when you'll start to see a recovery in home prices.

Related Quotes

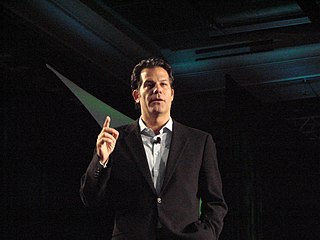

Mitt Romney and I don't agree on every issue and certainly housing is one of them. When you look at what is going on here in Southern Nevada, you can't say you got to let the housing market hit bottom. We have been bouncing along the bottom for years. And the fact is we have to do everything possible to: 1) keep people in their homes and 2) get people who are out of their homes back into their homes.

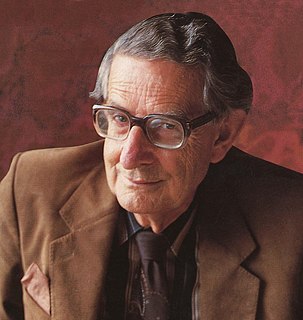

Housing has always been a key to Great Resets. During the Great Depression and New Deal, the federal government created a new system of housing finance to usher in the era of suburbanization. We need an even more radical shift in housing today. Housing has consumed too much of our economic resources and distorted the economy. It has trapped people who are underwater on their mortgages or can't sell their homes. And in doing so has left the labor market unable to flexibly adjust to new economic realities.