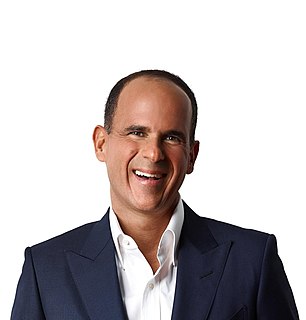

A Quote by Jamie Hyneman

I've run several of my own small businesses in my life.

Quote Topics

Related Quotes

Congress can protect small businesses by providing effective oversight over SBA policies and make sure they take into account the needs of small businesses while also protecting taxpayer dollars. Congress also needs to make sure that new banking regulations do not make it more costly for community banks to lend to small businesses.