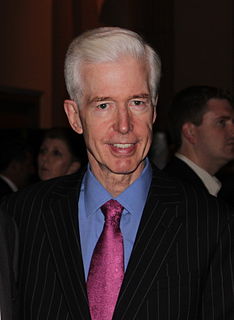

A Quote by Janet Yellen

Productivity growth, however it occurs, has a disruptive side to it. In the short term, most things that contribute to productivity growth are very painful.

Quote Topics

Related Quotes

My advice would be, as you consider fiscal policies, to keep in mind and look carefully at the impact those policies are likely to have on the economy's productive capacity, on productivity growth, and to the maximum extent possible, choose policies that would improve that long-run growth and productivity outlook.

The Federal Reserve's objectives of maximum employment and price stability do not, by themselves, ensure a strong pace of economic growth or an improvement in living standards. The most important factor determining living standards is productivity growth, defined as increases in how much can be produced in an hour of work.

Inflation is certainly low and stable and, measured in unemployment and labour-market slack, the economy has made a lot of progress. The pace of growth is disappointingly slow, mostly because productivity growth has been very slow, which is not really something amenable to monetary policy. It comes from changes in technology, changes in worker skills and a variety of other things, but not monetary policy, in particular.