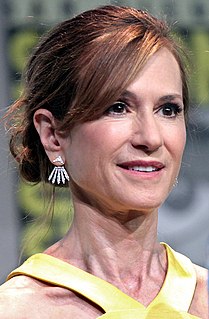

A Quote by Janet Yellen

If we were to raise interest rates too steeply, and we were to trigger a downturn or contribute to a downturn, we have limited scope for responding, and it is an important reason for caution.

Related Quotes

I've always believed that a speculative bubble need not lead to a recession, as long as interest rates are cut quickly enough to stimulate alternative investments. But I had to face the fact that speculative bubbles usually are followed by recessions. My excuse has been that this was because the policy makers moved too slowly - that central banks were typically too slow to cut interest rates in the face of a burst bubble, giving the downturn time to build up a lot of momentum.

A higher IOER rate encourages banks to raise the interest rates they charge, putting upward pressure on market interest rates regardless of the level of reserves in the banking sector. While adjusting the IOER rate is an effective way to move market interest rates when reserves are plentiful, federal funds have generally traded below this rate.

We've had one of these before, when the dot-com bubble burst. What I told our company was that we were just going to invest our way through the downturn, that we weren't going to lay off people, that we'd taken a tremendous amount of effort to get them into Apple in the first place; the last thing we were going to do is lay them off.

The Fed contributed to the financial crisis, keeping interest rates too low for too long. I give them credit for responding and stabilizing the economy and the financial sector during the crisis. But then they tried to do too much with quantitative easing that went on forever, just dramatically exploding their balance sheets.

The great bulk of the legal voters of the South were men who owned no slaves; their homes were generally in the hills and poor country; their facilities for educating their children, even up to the point of reading and writing, were very limited; their interest in the contest was very meagre--what there was, if they had been capable of seeing it, was with the North; they too needed emancipation.