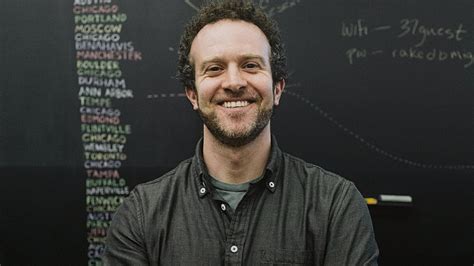

A Quote by Jason Fried

I'm generally risk averse, and most great entrepreneurs I know are as well.

Related Quotes

Basically if you study entrepreneurs, there is a misnomer: People think that entrepreneurs take risk, and they get rewarded because they take risk. In reality entrepreneurs do everything they can to minimize risk. They are not interested in taking risk. They want free lunches and they go after free lunches.

We are raising today's children in sterile, risk-averse and highly structured environments. In so doing, we are failing to cultivate artists, pioneers and entrepreneurs, and instead cultivating a generation of children who can follow the rules in organized sports games, sit for hours in front of screens and mark bubbles on standardized tests.

You need to put the fear of risk aside. Startups need leaders who are willing to persevere through the hard times. Failure is an option, and a real risk. Failure and risk are something entrepreneurs should understand well, and learn to manage. Don’t have a fear of talking about your failures. Don’t hide your mistakes.