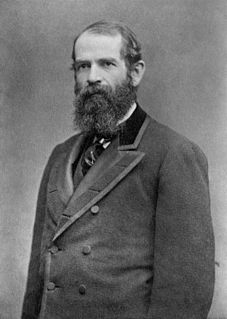

A Quote by Jay Gould

I have the disadvantage of not being sociable. Wall Street men are fond of company and sport. A man makes one hundred thousand dollars there and immediately buys a yacht, begins to race fast horses, and becomes a sport generally. My tastes lie in a different direction. When business hours are over I go home and spend the remainder of the day with my wife, my children, and books of my library. Every man has natural inclinations of his own. Mine are domestic. They are not calculated to make me particularly popular in Wall Street, and I cannot help that.

Quote Topics

Becomes

Begins

Being

Books

Business

Calculated

Cannot

Children

Company

Day

Different

Direction

Disadvantage

Dollars

Domestic

Every

Every Man

Fast

Fond

Generally

Go

Go Home

Help

His

Home

Horses

Hours

Hundred

Immediately

Library

Lie

Make

Makes

Man

Me

Men

Mine

My Children

My Wife

Natural

Over

Own

Particularly

Popular

Race

Sociable

Spend

Sport

Street

Tastes

Thousand

Wall

Wall Street

Wife

Yacht

Related Quotes

Wall Street can be a dangerous place for investors. You have no choice but to do business there, but you must always be on your guard. The standard behavior of Wall Streeters is to pursue maximization of self-interest; the orientation is usually short term. This must be acknowledged, accepted, and dealt with. If you transact business with Wall Street with these caveats in mind, you can prosper. If you depend on Wall Street to help you, investment success may remain elusive.

I heard governor Romney here called me an economic lightweight because I wasn't a Wall Street financier like he was. Do you really believe this country wants to elect a Wall Street financier as the president of the United States? Do you think that's the experience that we need? Someone who's going to take and look after as he did his friends on Wall Street and bail them out at the expense of Main Street America.

The dirty little secret of what used to be known as Wall Street securities firms-Goldman Sachs, Morgan Stanley, Merrill Lynch, Lehman Brothers, and Bear Stearns-was that every one of them funded their business in this way to varying degress, and every one of them was always just twenty-four hours away from a funding crisis. The key to day-to-day survival was the skill with which Wall Street executives managed their firms' ongoing reputation in the marketplace.

Wall Street owns the country. It is no longer a government of the people, for the people and by the people, but a government for Wall Street, by Wall Street, and for Wall Street. The great common people of this country are slaves, and monopoly is the master…Let the bloodhounds of money who have dogged us thus far beware.