A Quote by Jay Leno

The IRS says it's been getting death threats since the health care bill passed because the IRS is going to be the ones in charge of implementing it. They say the threats people are making to the IRS are so bad, that they are actually hindering the IRS's ability to threaten people.

Related Quotes

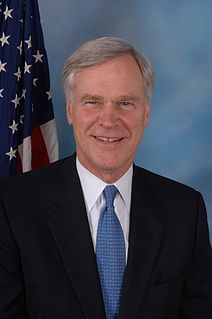

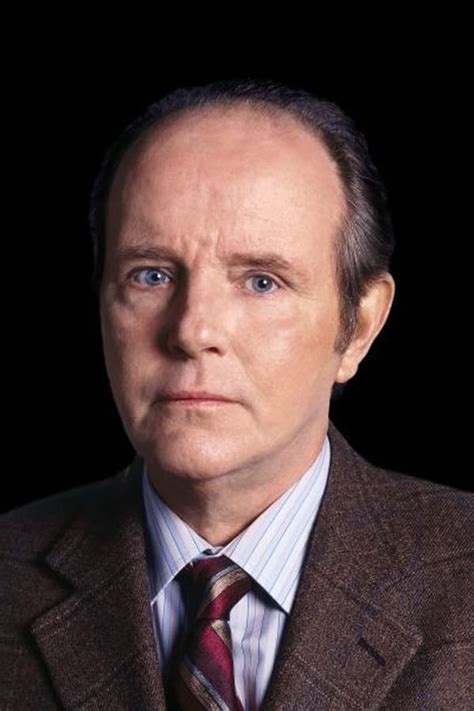

Much has already been learned about the arrogance of the IRS from the House investigations of the agency's targeting of conservatives. The revelations emerged despite strenuous efforts by Democrats in Washington and by the IRS itself to block inquiries and deny the existence of political targeting - targeting that the former head of the IRS Exempt Organizations Unit, Lois Lerner, eventually acknowledged and apologized for in May 2013.

Congress is supposed to fund the IRS, and it has been steadily reducing the number of auditors and tax collectors the IRS has at the very time that the tax system has become vastly more complicated. And of course America continues to grow, so there's an increasing number of tax returns coming in. The IRS responds by doing exactly what Congress expects of them. That shouldn't surprise anyone. All bureaucracies do what they are told.