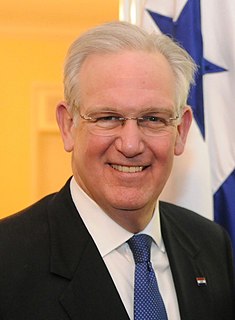

A Quote by Jay Nixon

Effective tax credits are used to create jobs and grow our economy. But tax credits that aren't delivering for Missourians must be retooled and reformed.

Related Quotes

Labour ministers often look puzzled when reports show that Britain has one of the lowest levels of social mobility in the developed world. They just don't get it. They see poverty, inequality, fairness, as all about income. For the past 12 years, they have relied on tax credits to solve this. But tax credits do not solve poverty: they mask it.

We must ensure full access to all reproductive health services, including abortion. We must also provide for our aging population, ensuring our parents and grandparents have the care they need. We must defend Medicare, expand Social Security, and provide tax credits for families who care for their elders and loved ones with disabilities.