A Quote by Jay Samit

State funds, private equity, venture capital, and institutional lending all have their role in the lifecycle of a high tech startup, but angel capital is crucial for first-time entrepreneurs. Angel investors provide more than just cash; they bring years of expertise as both founders of businesses and as seasoned investors.

Related Quotes

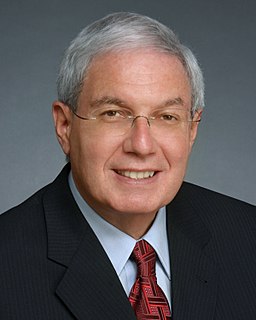

We want to encourage investors to target businesses that focus on achieving more than just profits - by placing their money into businesses that also positively contribute to social or environmental benefits in Ontario. Angel investors can help social enterprises grow and succeed, and through our partnership with the Network of Angel Organizations and the Impact Angel Alliance, we are making it easier for social ventures and angel investors to connect, contribute, and make our society a better place to live.

Most startup entrepreneurs unnecessarily spend half their time and give up half their equity in search of funding from angel investors and venture capitalists. Tens of millions of dollars are available to them for free from partners who not only don't want their equity, they don't even want to be paid back.

Too often, investors are the target of fraudulent schemes disguised as investment opportunities. As you know, if the balance is tipped to the point where investors are not confident that there are appropriate protections, investors will lose confidence in our markets, and capital formation will ultimately be made more difficult and expensive.

Millions of mutual-fund investors sleep well at night, serene in the belief that superior outcomes result from pooling funds with like-minded investors and engaging high-quality investment managers to provide professional insight. The conventional wisdom ends up hopelessly unwise, as evidence shows an overwhelming rate of failure by mutual funds to deliver on promises.