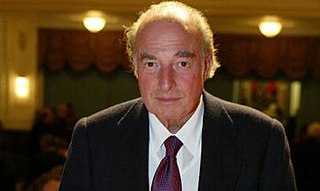

A Quote by Jay Samit

In my experience, there are only two valid reasons to take a company public: access to growth capital and investor fatigue.

Related Quotes

I basically see two reasons for a going public: Glencore gets access to more money. It is a way of funding your business and to finance growth. Plus: You have more liquid shares. It is easier to leave the company and redeem your shares. The 'going public' may also be an exit strategy for the top management.

There is always a critical job to be done. There is a sales door to be opened, a credit line to be established, a new important employee to be found, or a business technique to be learned. The venture investor must always be on call to advise, to persuade, to dissuade, to encourage, but always to help build. Then venture capital becomes true creative capital - creating growth for the company and financial success for the investing organization

Growth isn't central at all, because I'm trying to run this company as if it's going to be here a hundred years from now. And if you take where we are today and add 15% growth, like public companies need to have for their stock to stay up in value, I'd be a multi-trillion-dollar company in 40 years. Which is impossible, of course.

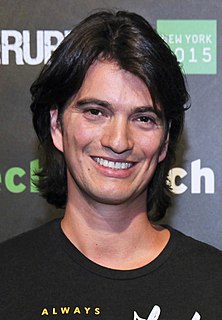

Basically my point of view on unicorns is that private companies which have sky high valuations, it doesn't really mean anything in the real world until it's marked to market. And there's only two ways things get marked to market in venture capital: Either a company is acquired by another company for cash or marketable security, or it goes public, and then it has reporting requirements and then the market will determine the value.