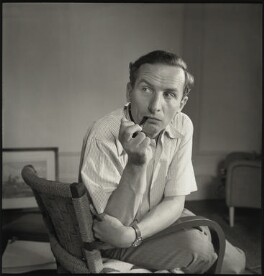

A Quote by Jean-Baptiste Say

Demand and supply are the opposite extremes of the beam, whence depend the scales of dearness and cheapness; the price is the point of equilibrium, where the momentum of the one ceases, and that of the other begins.

Related Quotes

I do believe that oil production globally has peaked at 85 million barrels. And I've been very vocal about it. And what happens? The demand continues to rise. The only way you can possibly kill demand is with price. So the price of oil, gasoline, has to go up to kill the demand. Otherwise, keep the price down, the demand rises.

In short, what the living wage is really about is not living standards, or even economics, but morality. Its advocates are basically opposed to the idea that wages are a market price-determined by supply and demand, the same as the price of apples or coal. And it is for that reason, rather than the practical details, that the broader political movement of which the demand for a living wage is the leading edge is ultimately doomed to failure: For the amorality of the market economy is part of its essence, and cannot be legislated away.

Four things have almost invariably followed the imposition of controls to keep prices below the level they would reach under supply and demand in a free market: (1) increased use of the product or service whose price is controlled, (2) Reduced supply of the same product or service, (3) quality deterioration, (4) black markets.

From the equilibrium and spontaneous order of Adam Smith and his heirs, from invisible-handed markets and perfect competition, supply and demand, and rewards and punishments, I was pushed to theories of disequilibrium and disorder, and information and noise, as the keys to understanding economic progress.