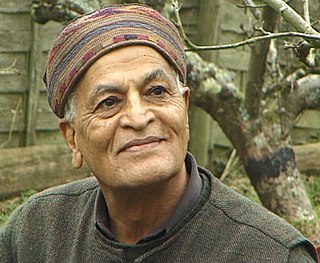

A Quote by Jean Chatzky

The older you are when you buy an annuity, the shorter your life expectancy will be - so the greater a monthly paycheck the same sum of money will buy you. When interest rates are higher, the size of the paycheck for the same sum of money will rise also.

Related Quotes

The time will come, and probably during 2009, that the only way the U.S. will be able to fund its deficits is to create money by printing it. The Treasury will have to sell bonds, and, in the absence of foreign buyers, the Fed will have to print the money to buy them. The consequence will be runaway inflation, increasing interest rates, recession, and inevitable tax increases on all Americans.

When I received the Nobel Prize, the only big lump sum of money I have ever seen, I had to do something with it. The easiest way to drop this hot potato was to invest it, to buy shares. I knew that World War II was coming and I was afraid that if I had shares which rise in case of war, I would wish for war. So I asked my agent to buy shares which go down in the event of war. This he did. I lost my money and saved my soul.

People worry that if they buy an annuity and then die before the policy starts to pay off, their heirs will lose out. I tell them, "What you should be more worried about is if you outlive your money, you will have to move in with your kids. Ask your kids which of these outcomes they are more worried about."

If you buy all the stocks selling at or below two times earnings, you will lose money on half of them because instead of making profits they will actually lose money, but you will only lose a dollar or so a share at most. Then others will be mediocre performers. But the remaining big winners will go up and produce fabulous results and also ensure a good overall result.

It's probably also smart to keep some money in cash to invest it. But I would resist at all costs taking a lump-sum distribution because the tendency is to spend out too fast in the early years of your retirement. The advice of professionals is to take out no more than 5% per year and that will give you 20 years of distributions, and at your age, 55, you probably have more than 20 years life expectancy.