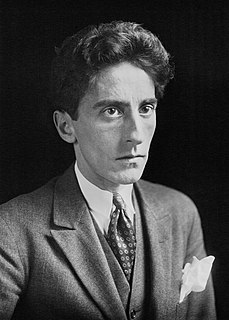

A Quote by Jean Cocteau

See your disappointments as good fortune. One plan's deflation is another's inflation.

Quote Topics

Related Quotes

With QE3, we are essentially being bought out with our own money...and unemployment is being used to facilitate this process in a very clever manner. Monetary inflation is currently being offset by labor deflation. The way you avoid collapse is by printing money and stealing assets. The way you avoid inflation is with labor deflation.

That's what courage is. Taking your disappointments and your failures, your guilt and your shame, all the wounds received and inflicted, and sinking them in the past. Starting again. Damning yesterday and facing tomorrow with your head held high. Times change. It's those that see it coming, and plan for it, and change themselves to suit, that prosper.

Significant changes in the growth rate of money supply, even small ones, impact the financial markets first. Then, they impact changes in the real economy, usually in six to nine months, but in a range of three to 18 months. Usually in about two years in the US, they correlate with changes in the rate of inflation or deflation."

"The leads are long and variable, though the more inflation a society has experienced, history shows, the shorter the time lead will be between a change in money supply growth and the subsequent change in inflation.

How you experience your life depends on how you look at it. If you look at it as a constant stream of difficulties and challenges, messes and problems, it will show up that way. If, on the other hand, you see it as a continuing flow of good fortune, one good thing after another, that is what you will encounter.