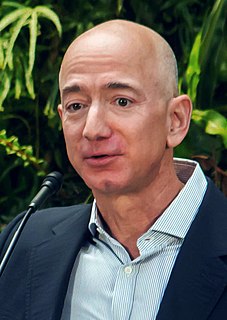

A Quote by Jeff Bezos

Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity and correspondingly stronger returns on invested capital.

Related Quotes

The financial doctrines so zealously followed by American companies might help optimize capital when it is scarce. But capital is abundant. If we are to see our economy really grow, we need to encourage migratory capital to become productive capital - capital invested for the long-term in empowering innovations.

Because these firms listened to their customers, invested aggressively in new technologies that would provide their customers more and better products of the sort they wanted, and because they carefully studied market trends and systematically allocated investment capital to innovations that promised the best returns, they lost their positions of leadership.

Christianity has held back any further advances in human consciousness for the past thousand years. And for the past century it's been in direct conflict with its illegitimate offspring, Communism (again with a capital C). Both ask the individual to sacrifice his self-interest to the higher goals of the organization. (Which is okay by me as long as it's voluntary; but as soon as either becomes too big - and takes on that damned capital C - they stop asking for cooperation and start demanding it.)

Any higher states of human enlightenment have been sacrificed between these two monoliths.