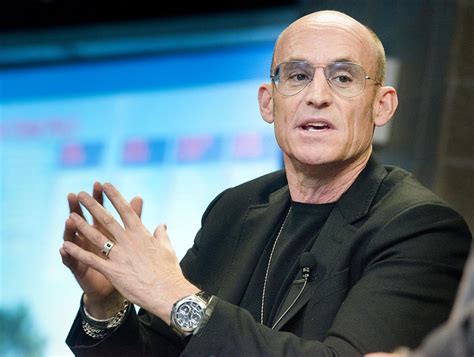

A Quote by Jeff Bezos

Percentage margins don't matter. What matters always is dollar margins: the actual dollar amount. Companies are valued not on their percentage margins, but on how many dollars they actually make, and a multiple of that.

Related Quotes

Percentage margins are not one of the things we are seeking to optimize. It’s the absolute dollar free cash flow per share that you want to maximize, and if you can do that by lowering margins, we would do that. So if you could take the free cash flow, that’s something that investors can spend. Investors can’t spend percentage margins.

Debt settlement companies work as a middleman between you and your creditor. If all goes well (and that's a big if), you should be able to settle your debts for cents on the dollar. You'll also pay a fee to the debt settlement company, usually either a percentage of the total debt you have or a percentage of the total amount forgiven.

How could Digital's collapse be so precipitous? It's because, in many ways, financial performance data is misleading. As you move up to the top of the market, you're getting rid of the less profitable products at the low end and adding business with more attractive margins at the high end. The rate of unit volume growth might be tapering off as you pursue these smaller markets, but your margins actually look better. So Wall Street rewards your stock price until you hit the ceiling.

The individuals inside are frequently fighting that their individual voices be heard, while the walls of the place, which are the mask, and the perception, are reluctant to give over to the voices of the individuals. Those in the margins are always trying to get to the center, and those at the center, frequently in the name of tradition, are trying to keep the margins at a distance. Part of the identity of a place is the tension between those in the margins, and those in the center, and they all live behind the walls which wear the tradition.

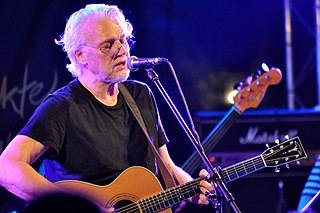

I work in the margins. The margins are where you'll find the nice people. You'll find real friends. You'll find honesty. You'll find integrity. You'll find relationships that will last you for a lifetime and will be there to support you in the bad times, which are the only relationships that matter anyway. Relationships that are all about power and money aren't worth having.

I don't think there is anything as powerful as an active heart. They do not fear the wisdom of emotion, but embody it. They know how to listen. They are polite when they need to be and unyielding when necessary. They remain open, even as they push boundaries and inhabit the margins, understanding eventually, the margins will move toward the center. They are tenacious, informed, patient, and impatient, at once. They do not shy away from what is difficult. They refuse to accept the unacceptable. The most effective activists I know are in love with the world.

The risk of an investment is described by both the probability and the potential amount of loss. The risk of an investment-the probability of an adverse outcome-is partly inherent in its very nature. A dollar spent on biotechnology research is a riskier investment than a dollar used to purchase utility equipment. The former has both a greater probability of loss and a greater percentage of the investment at stake.