A Quote by Jeffrey Kluger

Ambition is an expensive impulse, one that requires an enormous investment of emotional capital. Like any investment, it can pay off in countless different kinds of coin.

Related Quotes

When you look at this and where it's all going, the hardware business requires a lot of investment. It's very hard, it's very expensive, and ramping up hard on any given platform, whether it's a console or any kind of PC or mobile device, going into the hardware business requires a lot of investment.

What we prefer to do is operate our investment bank in a way that is like what investment banks used to be, which is a middle man - someone who is here to match people who need capital with people who have capital - and not position ourselves at the center of that by taking big positions on a trading stance.

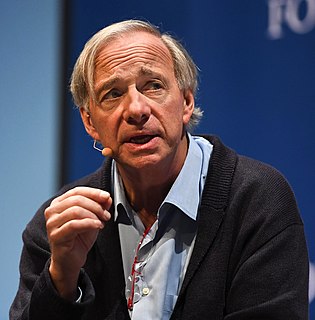

The biggest mistake investors make is to believe that what happened in the recent past is likely to persist. They assume that something that was a good investment in the recent past is still a good investment. Typically, high past returns simply imply that an asset has become more expensive and is a poorer, not better, investment.

A rentier is an investor whose relationship to a company or enterprise is strictly limited to the ownership of financial wealth (such as stocks or bonds) and the receipt of income on that wealth (such as dividends or interest). The financial system performs dismally at its advertised task, that of efficiently directing society's savings towards their optimal investment pursuits. The system is stupefyingly expensive, gives terrible signals for the allocation of capital, and has surprisingly little to do with real investment.

Below, we itemize some of the quite different lessons investors seem to have learned as of late 2009 - false lessons, we believe. To not only learn but also effectively implement investment lessons requires a disciplined, often contrary, and long-term-oriented investment approach. It requires a resolute focus on risk aversion rather than maximizing immediate returns, as well as an understanding of history, a sense of financial market cycles, and, at times, extraordinary patience.

My rather puritanical view is that any investment manager, whether operating as broker, investment counselor of a trust department, investment company, etc., should be willing to state unequivocally what he is going to attempt to accomplish and how he proposes to measure the extent to which he gets the job done.

On the Glass-Steagall thing, like I said, if you could demonstrate to me that it was a mistake, I'd be glad to look at the evidence. But I can't blame [the Republicans]. This wasn't something they forced me into. I really believed that given the level of oversight of banks and their ability to have more patient capital, if you made it possible for [banks] to go into the investment banking business as continental European investment banks could always do, that it might give us a more stable source of long-term investment.