A Quote by Jennifer Granholm

I've, we have in this state, like many other states, we're experiencing an enormous budget deficit that we're trying to grapple with. But we will have progress despite the deficits.

Related Quotes

Our practical choice is not between a tax-cut deficit and a budgetary surplus. It is between two kinds of deficits: a chronic deficit of inertia, as the unwanted result of inadequate revenues and a restricted economy; or a temporary deficit of transition, resulting from a tax cut designed to boost the economy, increase tax revenues, and achieve -- and I believe this can be done -- a budget surplus. The first type of deficit is a sign of waste and weakness; the second reflects an investment in the future.

I have long been in favor of a balanced budget restriction at the level of the federal government of the United States. Because the federal government has money-creating powers it can, in fact, be very damaging if it runs a series of budget deficits. With the state government in the United States, they don't have money-creating powers. The automatic discipline imposed by the fact that they are in a common monetary unit and don't have control over the money power means that the balanced budget restriction is less needed.

I said we are going to balance an $11 billion budget deficit in a $29 billion budget, so by percentage, the largest budget deficit in America, by percentage, larger than California, larger than New York, larger than Illinois. And we're going to balance that without raising taxes on the people of the state of New Jersey.

Meanwhile, the U.S. debt remains, as it has been since 1790, a war debt; the United States continues to spend more on its military than do all other nations on earth put together, and military expenditures are not only the basis of the government's industrial policy; they also take up such a huge proportion of the budget that by many estimations, were it not for them, the United States would not run a deficit at all.

I love listening to these guys give us lectures about debt and deficits. I inherited a trillion-dollar deficit. ... This notion that somehow we caused the deficits is just wrong. It's just not true. ... If they start trying to give you a bunch of facts and figures suggesting that it's true, what they're not telling you is they baked all this stuff into the cake with those tax cuts and a prescription drug plan that they didn't pay for and the wars.

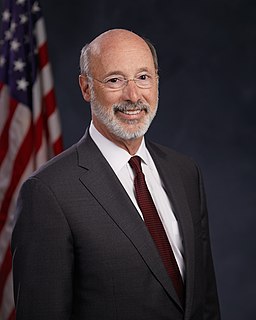

Pennsylvania is facing challenging economic times, a multi-billion dollar budget deficit, and negative cash flow projections. My Budget Deficit and Fiscal Stabilization Task Force will get to work to determine the scope of the challenges facing Pennsylvania and begin to discuss how we can get Pennsylvania's fiscal house in order.

The climate, financial and national security crises are all connected. They share the same cause: Our [the USA's] absurd dependency on foreign oil. As long as we need to spend billions of dollars each year to buy foreign oil from state-run oil companies in the Persian Gulf, our problems of a trade deficit, a budget deficit and a climate crisis will persist.

It is important for me, as a popular artist, to make clear to the governments of the United States and Mexico that despite the strategy of fear and intimidation to foreigners, despite their weapons, despite their immigration laws and military reserves, they will never be able to isolate the Zapatista communities from the people in the United States.

Senator McGovern is very sincere when he says that he will try to cut the military budget by 30%. And this is to drive a knife in the heart of Israel... Jews don't like big military budgets. But it is now an interest of the Jews to have a large and powerful military establishment in the United States... American Jews who care about the survival of the state of Israel have to say, no, we don't want to cut the military budget, it is important to keep that military budget big, so that we can defend Israel.