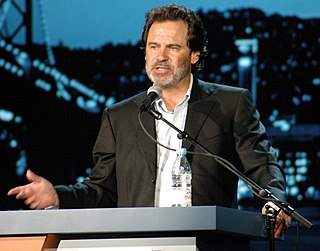

A Quote by Jeremy Grantham

When it comes to portfolios, my personal advice is for anyone who can, put money into forestry or farmland. Long term, you would probably never come near their returns in the stock market. In the world that I see, land is golden.

Related Quotes

In my opinion, the greatest misconception about the market is the idea that if you buy and hold stocks for long periods of time, you'll always make money. Let me give you some specific examples. Anyone who bought the stock market at any time between the 1896 low and the 1932 low would have lost money. In other words, there's a 36 year period in which a buy-and-hold strategy would have lost money. As a more modern example, anyone who bought the market at any time between the 1962 low and the 1974 low would have lost money.

The underlying strategy of the Fed is to tell people, "Do you want your money to lose value in the bank, or do you want to put it in the stock market?" They're trying to push money into the stock market, into hedge funds, to temporarily bid up prices. Then, all of a sudden, the Fed can raise interest rates, let the stock market prices collapse and the people will lose even more in the stock market than they would have by the negative interest rates in the bank. So it's a pro-Wall Street financial engineering gimmick.

We need a federal government commission to study the way our financial services system is working - I believe it is working badly - and we also need more educated investors. There are good long term low-priced mutual funds - my favorite is a total stock market index fund - and bad short term highly priced mutual funds. If investors would get themselves educated, and invest in the former - taking their money out of the latter - we would see some automatic improvements in the system, and see them fairly quickly.

If you put these five things together - you can't use money to attract talent, you can't advertise, you can't take risks, you can't invest in long-term results, and you don't have a stock market - then we have just put the humanitarian sector at the most extreme disadvantage to the for-profit sector on every level, and then we call the whole system charity, as if there is something incredibly sweet about it.

Over the long term, despite significant drops from time to time, stocks (especially an intelligently selected stock portfolio) will be one of your best investment options. The trick is to GET to the long term. Think in terms of 5 years, 10 years and longer. Do your planning and asset allocation ahead of time. Choose a portion of your assets to invest in the stock market - and stick with it! Yes, the bad times will come, but over the truly long term, the good times will win out - and I hope the lessons from 2008 will help get you there to enjoy them.

Investors, of course, can, by their own behavior make stock ownership highly risky. And many do. Active trading, attempts to "time" market movements, inadequate diversification, the payment of high and unnecessary fees to managers and advisors, and the use of borrowed money can destroy the decent returns that a life-long owner of equities would otherwise enjoy. Indeed, borrowed money has no place in the investor's tool kit.

It is argued by our GDP obsessed policy planners that eventually the money being made by the stock market operators or the IT industry would trickle down to the poor farmers in terms of ancillary jobs that would be created. But the fact is, that this has not happened, despite the boom in the stock market and the IT industry.