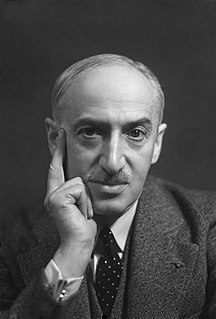

A Quote by Jeremy Siegel

The good thing about the dividend-paying stocks is, first of all you have stocks, which are real assets if we have some inflation. I think we're going to have 2%, 3% maybe 4%. That's a sweet spot for stocks. Corporations do well with that. It gives them pricing power. Their assets move up with prices. I'm not fearful of that inflation.

Related Quotes

Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?

Stock prices are likely to be among the prices that are relatively vulnerable to purely social movements because there is no accepted theory by which to understand the worth of stocks....investors have no model or at best a very incomplete model of behavior of prices, dividend, or earnings, of speculative assets.

For all your long-term investments, such as retirement accounts that you won't touch for at least ten years, you need a mix of stocks and bonds. Stocks offer the best shot at inflation-beating gains. But stocks don't always go up. That's where bonds come into play: They have less upside potential, but they also do not pack the same risk.

There is no such thing as agflation. Rising commodity prices, or increases in any prices, do not cause inflation. Inflation is what causes prices to rise. Of course, in market economies, prices for individual goods and services rise and fall based on changes in supply and demand, but it is only through inflation that prices rise in aggregate.