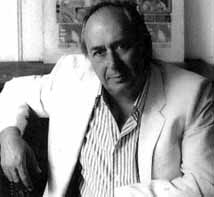

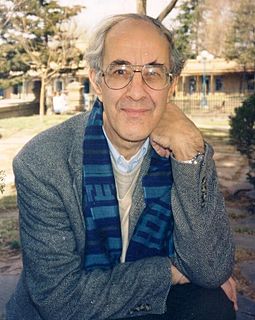

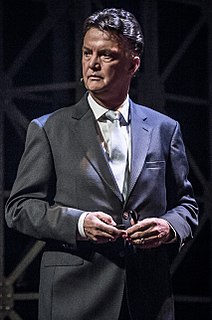

A Quote by Jeroen van der Veer

Shell estimates that after 2015 supplies of easy-to-access oil and gas will no longer keep up with demand.

Related Quotes

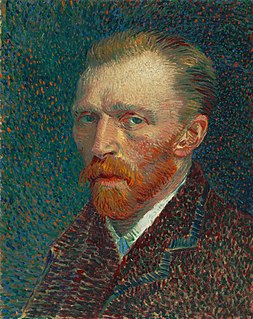

Scientists had said, "If you keep burning coal and gas and oil, you will melt the Arctic." And then the Arctic melted just as they had predicted. Did Shell Oil look at the melt and say, "Huh, maybe we should go into the solar-panel business instead?" No, Shell Oil looked at that and said, "Oh, well, now that it's melted it will be easier to drill for more oil up there." That's enough to make you doubt about the big brain being a good adaptation.

I do believe that oil production globally has peaked at 85 million barrels. And I've been very vocal about it. And what happens? The demand continues to rise. The only way you can possibly kill demand is with price. So the price of oil, gasoline, has to go up to kill the demand. Otherwise, keep the price down, the demand rises.

Even if America tomorrow - and it won't happen overnight - but if we did reduce our demand for gas and natural gas and crude oil by a significant degree, that does have an exponential effect on producers in the Middle East, everything else being equal. But if China's demand is growing and India's demand is growing, they are not going back.

I can at once refute the statement that the people of the West object to conservation of oil resources. They know that there is a limit to oil supplies and that the time will come when they and the Nation will need this oil much more than it is needed now. There are no half measures in conservation of oil.

Americans once believed that their prosperity and way of life depended on having assured access to Persian Gulf oil. Today, that is no longer the case. The United States is once more an oil exporter. Available and accessible reserves of oil and natural gas in North America are far greater than was once believed. Yet the assumption that the Persian Gulf still qualifies as crucial to American national security persists in Washington. Why?

About 75% of the price of gas is really dictated by crude oil. At the heart of the issue is increasing demand over a period of many years around the world. World crude oil consumption now is close to 90 million barrels a day. Most of the growth in demand is coming from China and the developing world.

Almost all of the demand for oil that suddenly pushed prices up was speculative demand. People began to speculate not only in stocks and bonds and real estate, but also in commodities. The market went up for old tankers, which were used simply to store oil in. A lot of the oil was simply being stored for trading, not used.

Venezuela has the biggest oil reserves in the world. And the biggest gas reserves in this hemisphere, the eighth in the world. Venezuela was a U.S. oil colony. All of our oil was going up to the north, and the gas was being used by the U.S. and not by us. Now we are diversifying. Our oil is helping the poor.