A Quote by Jerome Powell

The sale of Treasury bonds, notes, and bills finances the U.S. government, and those securities are, in turn, a primary vehicle for savings for a wide range of U.S. households. Treasury securities are also an important source of collateral within the financial system.

Related Quotes

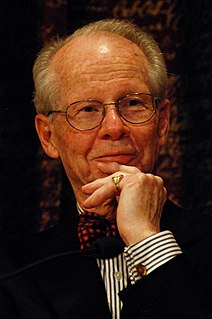

Maybe [the Republicans] 'll find ways around it, but the financial system of the world depends very heavily on the credibility of the US Treasury Department. US Treasury securities are what's called "good as gold"; they're the basis of international finance, and if the government can't uphold them, if they become valueless, the effect on the international financial system could be quite severe. But in order to destroy a limited health-care law, the right-wing Republicans, the reactionary Republicans, are willing to do that.

The organization of the government itself is something which we ought to examine in a more self-conscious way - the Federal Reserve and the Treasury and the Securities and Exchange Commission. The mission that each of them has is mainly economic but should be informed by good organizational practices.

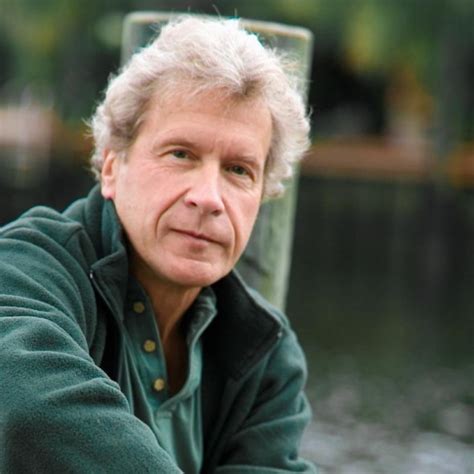

Confidence is key. You're not going to leave your money with me unless you're confident I'm going to give it back to you. And at this point, when treasury bills, seven day treasury bills at 1/20th of one percent, it's not because people want to earn 1/20th of one percent, it's because they trust the fact the treasury will give it back to them next week.