A Quote by Jerome Powell

My colleagues on the Board of Governors and I understand the value of having a diverse financial system that includes a large and vibrant contingent of community banks.

Related Quotes

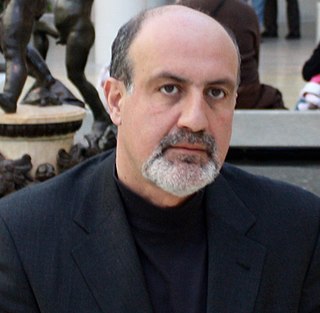

Financial institutions have been merging into a smaller number of very large banks. Almost all banks are interrelated. So the financial ecology is swelling into gigantic, incestuous, bureaucratic banks-when one fails, they all fall. We have moved from a diversified ecology of small banks, with varied lending policies, to a more homogeneous framework of firms that all resemble one another. True, we now have fewer failures, but when they occur... I shiver at the thought.

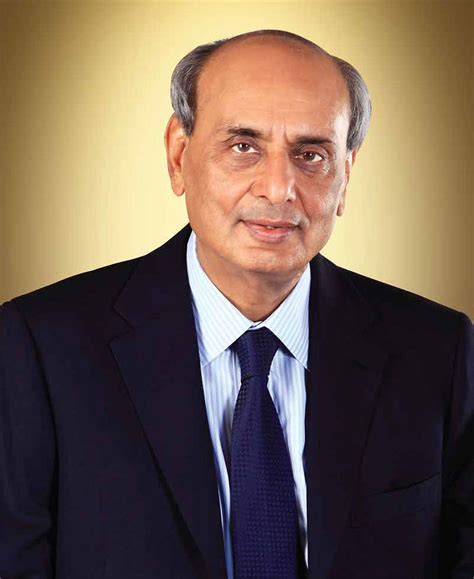

Finance ministers and central bank governors have the seats at the table, not labor unions or labor ministers. Finance ministers and central bank governors are linked to financial communities in their countries, so they push policies that reflect the viewpoints and interests of the financial community and barely hear the voices of those who are the first victims of dictated policies.

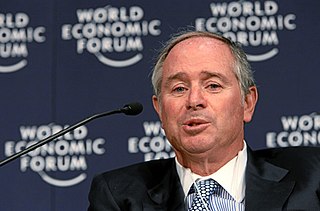

The powers of financial capitalism had a far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences.