A Quote by Jesse Lauriston Livermore

Experience has proved to me that real money made in speculating has been in commitments in a stock or commodity showing a profit right from the start.

Related Quotes

It never was my thinking that made the big money for me. It always was my sitting. Got that? My sitting tight! It is no trick at all to be right on the market. You always find lots of early bulls in bull markets and early bears in bear markets. I've known many men who were right at exactly the right time, and began buying or selling stocks when prices were at the very level which should show the greatest profit. And their experience invariably matched mine--that is, they made no real money out of it. Men who can both be right and sit tight are uncommon.

When I say the economy is shrinking, it's the economy of the 99%, the people who have to work for a living and depend on earning money for what they can spend. The 1% makes its money basically by lending out their money to the 99%, on charging interest and speculating. So the stock market's doubled, the bond market's gone way up, and the 1% are earning more money than ever before, but the 99% are not. They're having to pay the 1%.

Economic theory has nothing to say as to what commodity will acquire the status of money. Historically, it happened to be gold. But if the physical makeup of our world would have been different or is to become different from what it is now, some other commodity would have become or might become money. The market will decide.

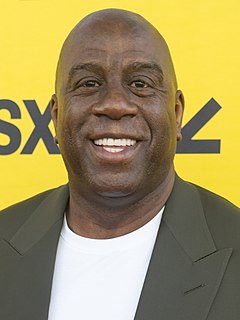

I tell people to look at me and understand that everybody first told me that I couldn't be a 6-foot, 9-inch point guard, and I proved them wrong. Then they told me I couldn't be a businessman and make money in urban America, and I proved them wrong. And they thought I couldn't win all these championships, and I proved them wrong there as well.

I’d say that Berkshire Hathaway’s system is adapting to the nature of the investment problem as it really is. We’ve really made the money out of high quality businesses. In some cases, we bought the whole business. And in some cases, we just bought a big block of stock. But when you analyze what happened, the big money’s been made in the high quality businesses. And most of the other people who’ve made a lot of money have done so in high quality businesses.