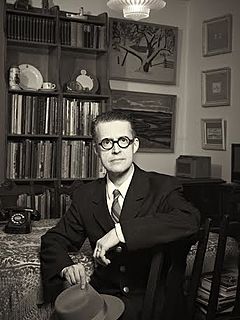

A Quote by Jesse Lauriston Livermore

If you can't sleep at night because of your stock market position, then you have gone too far. If this is the case, then sell your position down to the sleeping level.

Related Quotes

J.P. Morgan once had a friend who was so worried about his stock holdings that he could not sleep at night. The friend asked, 'What should I do about my stocks?' Morgan replied, 'Sell down to your sleeping point' Every investor must decide the trade-off he or she is willing to make between eating well and sleeping well. High investment rewards can only be achieved at the cost of substantial risk-taking. So what is your sleeping point? Finding the answer to this question is one of the most important investment steps you must take.

If you become so frightened of realities that are not your own, if you take upon yourselves tragedies that do not exist in your reality, in your moment, then you weaken your position and weaken the position, of those you think you are helping. You look about you and you see only hopelessness and helplessness. You organize your reality according to the tragedies of the newspapers!

I realised you owned me one night in this room. I was singing to you and you were sleeping. You made a little noise in your sleep like you were distressed and I panicked and ran to your side. You grabbed my arm in your sleep and pulled it up against your face and went back to sleep. I didn't want to ever move.

The correct attitude of the security analyst toward the stock market might well be that of a man toward his wife. He shouldn't pay too much attention to what the lady says, but he can't afford to ignore it entirely. That is pretty much the position that most of us find ourselves vis-à-vis the stock market.

Just remember, without discipline, a clear strategy, and a concise plan, the speculator will fall into all the emotional pitfalls of the market - jump from one stock to another, hold a losing position too long, and cut out of a winner too soon, for no reason other than fear of losing profit. Greed, Fear, Impatience, Ignorance, and Hope will all fight for mental dominance over the speculator. Then, after a few failures and catastrophes the speculator may become demoralised, depressed, despondent, and abandon the market and the chance to make a fortune from what the market has to offer.