A Quote by Jesse Lauriston Livermore

He really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape but in sizing up the entire market and its trend.

Related Quotes

Time is the most important factor in determining market movements and by studying past price records you will be able to prove to yourself history does repeat and by knowing the past you can tell the future. There is a definite relation between price and time. By studying time cycles and time periods you will learn why market tops and bottoms are found at certain times, and why resistance levels are so strong at certain times, and prices hold around them. The most money is made when fast moves and extreme fluctuations occur at the end of major cycles.

Disregarding the big swing and trying to jump in and out was fatal to me. Nobody can catch all the fluctuations. In a bull market your game is to buy and hold until you believe that the bull market is near its end. To do this you must study general conditions and not tips or special factors affecting individual stocks.

The market being in a trend is the main thing that eventually gets us in a trade. That is a pretty simple idea. Being consistent and making sure you do that all the time is probably more important than the particular characteristics you use to define the trend. Whatever method you use to enter trades, the most critical thing is that if there is a major trend, your approach should assure that you get in that trend.

The most realistic distinction between the investor and the speculator is found in their attitude toward stock-market movements. The speculator's primary interest lies in anticipating and profiting from market fluctuations. The investor's primary interest lies in acquiring and holding suitable securities at suitable prices. Market movements are important to him in a practical sense, because they alternately create low price levels at which he would be wise to buy and high price levels at which he certainly should refrain from buying and probably would be wise to sell.

We must continue to liberalise the single market, cut red tape and basically create a digital single market. We have not completed the single market yet, there is not sufficient free movement of goods, labour, services and money. We have to keep on working at that against all the protectionist tendencies that we have right now.

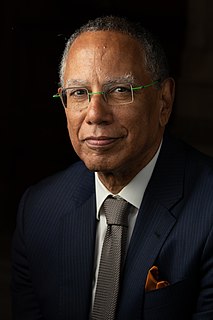

The fact that Edward Snowden didn't approach the New York Times hurt a lot. It meant two things. Morally, it meant that somebody with a big story to tell didn't think we were the place to go, and that's painful. And then it also meant that we got beaten on what was arguably the biggest national security story in many, many years. Not only beaten by the Guardian, because he went to the Guardian, but beaten by the Post, because he went to a writer from the Post. We tried to catch up and did some really good stories that I feel good about. But it was really, really, really painful.

It’s a shame, sort of a waste, that most people are influenced by what the newspaper supplements tell them is the book they are meant to be seen reading this year. It seems like those people aren’t really interested in books. If you’re really into books, you havoc all over the place picking up disparate stuff which you devour hungrily, and the ‘selection’ process is more like a sixth sense hunger, a billion miles away from fashion.