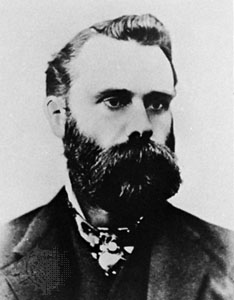

A Quote by Jesse Lauriston Livermore

For instance, let us say that a new stock has been listed in the last two or three years and its high was 20, or any other figure, and that such a price was made two or three years ago. If something favorable happens in connection with the company, and the stock starts upward, usually it is safe play to buy the minute it touches a brand new high.

Related Quotes

I'd done some acting in high school. Then I went to Kenyon College and got thrown in jail and kicked off the football team. Since I was determined not to study very much, I majored in theater the last two years. Got my degree in speech; they didn't actually have a degree in theater. I graduated at two o'clock in the afternoon, and at three-thirty I was on the train for Williams Bay, Wisconsin, for summer stock, and then I did winter stock.

The public, as a whole, buys at the wrong time and sells at the wrong time. The average operator, when he sees two or three points profit, takes it; but, if a stock goes against him two or three points, he holds on waiting for the price to recover, with oftentimes, the result of seeing a loss of two or three points run into a loss of ten points.

In the space of one hundred and seventy-six years the Mississippi has shortened itself two hundred and forty-two miles. Therefore, in the Old Silurian Period the Mississippi River was upward of one million three hundred thousand miles long, seven hundred and forty-two years from now the Mississippi will be only a mile and three-quarters long. There is something fascinating about science. One gets such wholesome returns of conjecture out of such a trifling investment of fact.

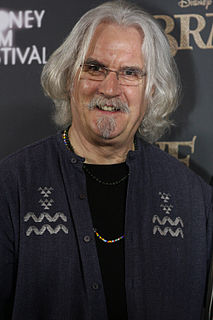

I’ve come in and out of America for… well, I’ve lived here for 15 years. And I’ve played here for nearly 30 years. On and off. But I’ve always played to my fan base. And I can come and do two or three nights in New York or two or three nights in L.A., and all that. But when I go away, nobody knows I’ve been gone. You know, I don’t get reviewed or anything like that. So that’s why I’ve come back and done a longer time in a smaller place, in New York. It’s always the people who live here that get a chance to know me.