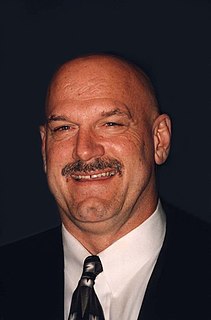

A Quote by Jesse Ventura

In the United States, if you buy a property and you're a good citizen, and you improve that property, what do they do to you? They tax you more. So they penalize you for good behavior.

Quote Topics

Related Quotes

As to the Income Tax, my opinion is that the needful revenue would be fairly and most fairly raised if paid by property, and by individuals in proportion to their property. A Property Tax should be an assessment upon all land and buildings, and canals and railroads, but not on property such as machinery, stock in trade, etc. The aristocracy have squeezed all they can out of the mass of the consumers, and now they lay their daring hands on those not wholly impoverished.

If you behave like a good citizen, and you upgrade and improve your property, your reward will be the government will take more money from you. So using that analogy, you should let your house become the shithole on the block and they'll reduce your taxes and you'll pay less. Be a bad citizen with your neighbors, right? You'll save money then.

Legislators cannot invent too many devices for subdividing property... Another means of silently lessening the inequality of property is to exempt all from taxation below a certain point, and to tax the higher portions of property in geometrical progression as they rise. Whenever there is in any country, uncultivated lands and unemployed poor, it is clear that the laws of property have been so far extended as to violate natural right.

I think that [Donald] Trump is brilliant to raise this issue. When my son, Gabriel, and his wife, Deb, was pregnant, I said, You got to come home. I want my grandson to be president of the United States. He has to be born in the United States.Now, a child of a citizen of the United States born abroad or born wheresoever is a citizen if that's - he or she so chooses. So there's no doubt but that Ted Cruz is a citizen of the United States.

One ideological claim is that private property is theft, that the natural product of the existence of property is evil, and that private ownership therefore should not exist... What those who feel this way don't realize is that property is a notion that has to do with control - that property is a system for the disposal of power. The absence of property almost always means the concentration of power in the state.

The power of the state to impose restraints and burdens upon persons and property in conservation and promotion of the public health, good order, and prosperity is a power originally and always belonging to the states, not surrendered to them by the general government, nor directly restrained by the constitution of the United States, and essentially exclusive.