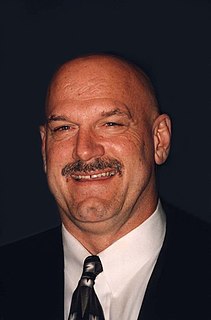

A Quote by Jesse Ventura

If you're a Mexican citizen whether you live in a shanty shack or the big palace on the beach, when you turn 65, your property taxes are cut in half.

Related Quotes

You've worked hard all your life. You've paid Medicare taxes for almost 30 years. But under the Republican plan, Medicare won't be there for you. Instead of Medicare as it exists now, under the Republican plan you'll get a voucher that will pay as little as half your Medicare costs when you turn 65—and as little as a quarter in your 80s. And all so that millionaires and billionaires can have a huge tax cut.

If you behave like a good citizen, and you upgrade and improve your property, your reward will be the government will take more money from you. So using that analogy, you should let your house become the shithole on the block and they'll reduce your taxes and you'll pay less. Be a bad citizen with your neighbors, right? You'll save money then.

Income and inheritance taxes imply the denial of private property, and in that are different in principle from all other taxes. The government says to the citizen: “Your earnings are not exclusively your own; we have a claim on them, and our claim precedes yours; we will allow you to keep some of it, because we recognize your need, not your right; but whatever we grant you for yourself is for us to decide.

The government taxes you when you bring home a paycheck.

It taxes you when you make a phone call.

It taxes you when you turn on a light.

It taxes you when you sell a stock.

It taxes you when you fill your car with gas.

It taxes you when you ride a plane.

It taxes you when you get married.

Then it taxes you when you die.

This is taxual insanity and it must end.

Your profits are going to be cut down to a reasonably low level by taxation. Your income will be subject to higher taxes. Indeed in these days, when every available dollar should go to the war effort, I do not think that any American citizen should have a net income in excess of $25,000 per year after payment of taxes.

Whenever you get involved with talking about rights, you're talking about being a citizen. You're talking about being a citizen in capitalism; you're talking about what rights are granted to what identities, under what laws, and all that is a big mix. Marriage is, among many other things, a formality to channel capital through a family. And that's why the big DOMA lawsuit was about paying too many taxes! "I wouldn't have had to pay all these taxes if Theodora had been Theo" - that was the big tagline. It's all about protecting assets.

A product of your life and liberty is your property. Property is the fruit of your labor, the product of your time, energy, and talents. It is that part of nature that you turn to valuable use. And it is the property of others that is given to you by voluntary exchange and mutual consent. Two people who exchange property voluntarily are both better off or they wouldn't do it. Only they may rightfully make that decision for themselves.