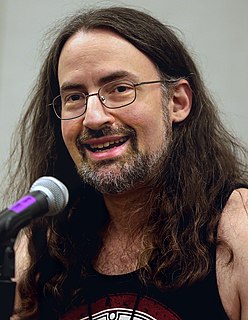

A Quote by Jim Butcher

Just like credit card companies, or those student loan people. Now there's evil for you.

Related Quotes

If you have credit card debt and credit card companies continue to close down the cards, what are you going to do? What are you going to do if they raise your interest rates to 32 percent? That's five times higher than what your kid is going to pay in interest on a student loan. Get rid of your credit card debt.

It's critical to level the playing field, to make prices and risks clear up front, so when someone signs on for a student loan or a mortgage or a credit card, they know the tricks and traps hidden in the fine print. That's why the Consumer Financial Protection Bureau has been working on a new financial aid shopping sheet. A shorter, two-page credit card agreement, a simpler mortgage disclosure form. All those are aimed toward helping people understand the basic bargain.

I have no credit cards. That was the decision that was made jointly by the credit card companies, and by me. I can't say that that was completely on my account. I buy nothing on credit now, nothing. If I can't afford it, I don't buy it. I have a debit card, that's all I have. Any debt that I have, I am paying down.

A consolidation makes sense only if you can lower your overall interest rate. Many people consolidate by taking out a home equity line loan or home equity line of credit (HELOC), refinancing a mortgage, or taking out a personal loan. They then use this cheaper debt to pay off more expensive debt, most frequently credit card loans, but also auto loans, private student loans, or other debt.

Debt is so ingrained into our culture that most Americans can't even envision a car without a payment ... a house without a mortgage ... a student without a loan ... and credit without a card. We've been sold debt with such repetition and with such fervor that most folks can't conceive of what it would be like to have NO payments.

In about one-third of credit card consolidations, within a short period of time, the cards come back out of the wallet, and in no time at all, they're charged back up. Then you're in an even worse position, because you have the credit card debt and the consolidation loan to worry about. You're in a hole that's twice as deep - and twice as steep.