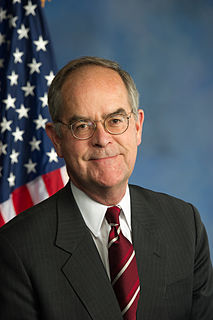

A Quote by Jim Cooper

If Congress wanted to intervene with the Federal Reserve, well, we created the Federal Reserve. We could uncreate it. But would you want Congress regulating the money supply? We'd have drowned in inflation, or gone bankrupt, decades ago.

Related Quotes

It may seem strange, but Congress has never developed a set of goals for guiding Federal Reserve policy. In founding the System, Congress spoke about the country's need for "an elastic currency." Since then, Congress has passed the Full Employment Act, declaring its general intention to promote "maximum employment, production, and purchasing power." But it has never directly counseled the Federal Reserve.

If the Federal Reserve pursues a policy which Congress or the President believes not to be in the public interest, there is nothing Congress can do to reverse the policy. Nor is there anything the people can do. Such bastions of unaccountable power are undemocratic. The Federal Reserve System must be reformed, so that it is answerable to the elected representatives of the people.

The tenth amendment said the federal government is supposed to only have powers that were explicitly given in the Constitution. I think the federal government's gone way beyond that. The Constitution never said that you could have a Federal Reserve that would have $2.8 trillion in assets. We've gotten out of control.

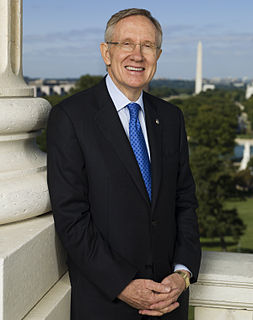

Hyperinflation is not going to happen in this country, will never happen... The Fed putting so much money into the system is not going to create the risk of hyperinflation in the future. We have a strong independent Federal Reserve with a very strong mandate from the Congress, and they will do what's necessary to keep inflation low and stable over time.

When it comes to the Federal Reserve, there's an awful lot of books out there; in my library, I bet I've got 200 books if I've got any on the Federal Reserve. And we don't need any more books, we need action, and that's what the Liberty Dollar did, it gave people a way to take action. Our catch phrase was you want to "make money, do good, and have fun," and people really responded to that.