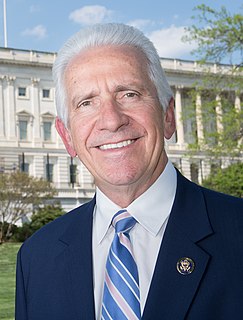

A Quote by Jim Costa

We have for too long put vast oil and natural gas reserves off limits to exploration and production, as The Washington Post editorial stated this week.

Quote Topics

Related Quotes

As much as with increased exploration new gas reserves can be found, what must be obvious to all is that our oil and gas reserves are not renewable and they are diminishing, and to protect the generations to come, we must engage in nothing short of a radical shift in the diversification of the economy.

Regardless of how you feel about peak oil or global warming, the increased use of natural gas is a positive thing because it is being found at a rate that is faster than that of new oil reserves, it is relatively abundant, and our reserves are longer lived than our oil reserves... It does not get the kind of attention it deserves.

Venezuela has the biggest oil reserves in the world. And the biggest gas reserves in this hemisphere, the eighth in the world. Venezuela was a U.S. oil colony. All of our oil was going up to the north, and the gas was being used by the U.S. and not by us. Now we are diversifying. Our oil is helping the poor.

The momentum of Asia's economic development is already generating massive pressures for the exploration and exploitation of new sources of energy and the Central Asian region and the Caspian Sea basin are known to contain reserves of natural gas and oil that dwarf those of Kuwait, the Gulf of Mexico, or the North Sea.

Americans once believed that their prosperity and way of life depended on having assured access to Persian Gulf oil. Today, that is no longer the case. The United States is once more an oil exporter. Available and accessible reserves of oil and natural gas in North America are far greater than was once believed. Yet the assumption that the Persian Gulf still qualifies as crucial to American national security persists in Washington. Why?

Gas prices in many parts of the country are nearing $4 a gallon; it could get even worse as unrest spreads throughout the oil-exporting Middle East. Yet the Obama administration once again seems to see no crisis. It has curtailed new leases for offshore oil exploration for seven years and exempted thousands of acres in the West from new drilling. It will not reconsider opening up small areas of Alaska with known large oil reserves.